(

)

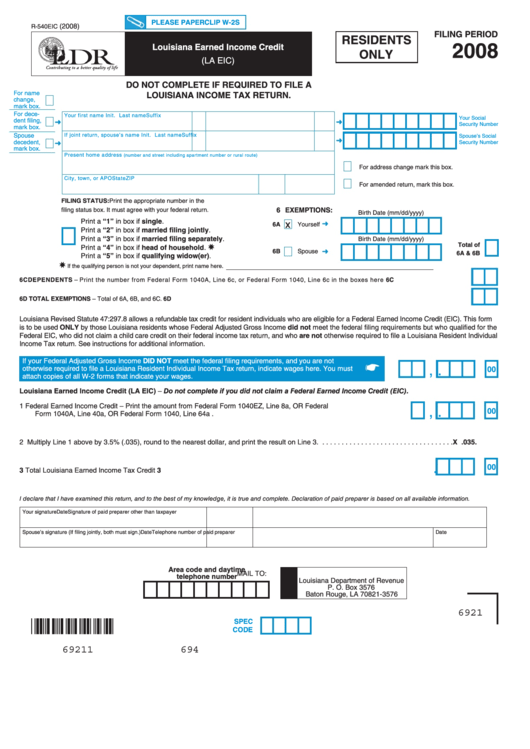

PLEASE PAPERCLIP W-2S

(2008)

R-540EIC

FILING PERIOd

RESIdENTS

2008

Louisiana Earned Income Credit

ONLY

(LA EIC)

dO NOT COMPLETE IF REQUIREd TO FILE A

For name

LOUISIANA INCOME TAX RETURN.

change,

mark box.

For dece-

Your first name

Init. Last name

Suffix

Your Social

dent filing,

Security Number

mark box.

If joint return, spouse’s name

Init. Last name

Suffix

Spouse

Spouse’s Social

decedent,

Security Number

mark box.

Present home address

(number and street including apartment number or rural route)

For address change mark this box.

City, town, or APO

State

ZIP

For amended return, mark this box.

FILING STATUS: Print the appropriate number in the

6 EXEMPTIONS:

filing status box. It must agree with your federal return.

Birth Date (mm/dd/yyyy)

Print a “1” in box if single.

x

6A

Yourself

Print a “2” in box if married filing jointly.

Print a “3” in box if married filing separately.

Birth Date (mm/dd/yyyy)

Total of

X

Print a “4” in box if head of household.

6B

Spouse

6A & 6B

Print a “5” in box if qualifying widow(er).

X

If the qualifying person is not your dependent, print name here.

6C dEPENdENTS – Print the number from Federal Form 1040A, Line 6c, or Federal Form 1040, Line 6c in the boxes here . . . . . . . . . . . . . 6C

6d TOTAL EXEMPTIONS – Total of 6A, 6B, and 6C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6d

Louisiana Revised Statute 47:297 .8 allows a refundable tax credit for resident individuals who are eligible for a Federal Earned Income Credit (EIC). This form

is to be used ONLY by those Louisiana residents whose Federal Adjusted Gross Income did not meet the federal filing requirements but who qualified for the

Federal EIC, who did not claim a child care credit on their federal income tax return, and who are not otherwise required to file a Louisiana Resident Individual

Income Tax return. See instructions for additional information.

If your Federal Adjusted Gross Income dId NOT meet the federal filing requirements, and you are not

,

.

otherwise required to file a Louisiana Resident Individual Income Tax return, indicate wages here. You must

00

attach copies of all W-2 forms that indicate your wages.

Louisiana Earned Income Credit (LA EIC) – Do not complete if you did not claim a Federal Earned Income Credit (EIC).

1

Federal Earned Income Credit – Print the amount from Federal Form 1040EZ, Line 8a, OR Federal

,

.

00

Form 1040A, Line 40a, OR Federal Form 1040, Line 64a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Multiply Line 1 above by 3.5% (.035), round to the nearest dollar, and print the result on Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X .035.

.

00

3

Total Louisiana Earned Income Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . REFUNd . . . . . . . . . . . . . . . . . . . . . . . 3

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based on all available information.

Your signature

Date

Signature of paid preparer other than taxpayer

Spouse’s signature (If filing jointly, both must sign.)

Date

Telephone number of paid preparer

Date

Area code and daytime

MAIL TO:

telephone number

Louisiana Department of Revenue

P. O. Box 3576

Baton Rouge, LA 70821-3576

6921

SPEC

COdE

69211

694

1

1