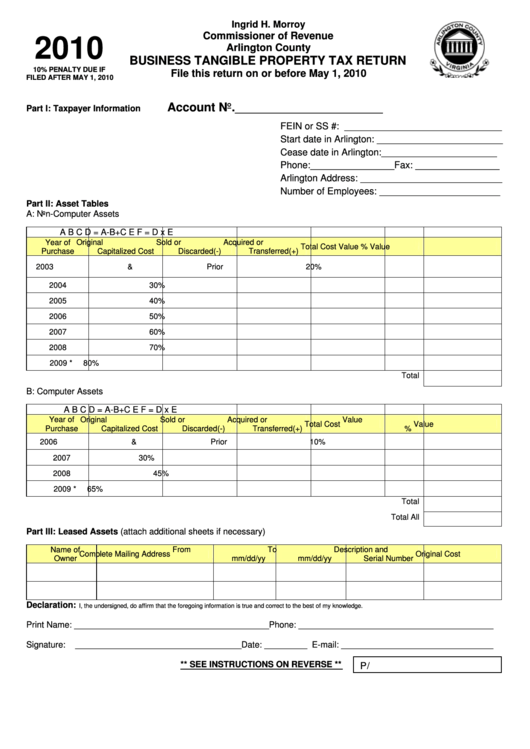

Business Tangible Property Tax Return Form - 2010

ADVERTISEMENT

Ingrid H. Morroy

Commissioner of Revenue

2010

Arlington County

BUSINESS TANGIBLE PROPERTY TAX RETURN

10% PENALTY DUE IF

File this return on or before May 1, 2010

FILED AFTER MAY 1, 2010

Account No.______________________

Part I: Taxpayer Information

FEIN or SS #: ______________________________

Start date in Arlington: ________________________

Cease date in Arlington: ______________________

Phone: ________________Fax: ________________

Arlington Address: ___________________________

Number of Employees: _______________________

Part II: Asset Tables

A: Non-Computer Assets

A

B

C

D = A-B+C

E

F = D x E

Year of

Original

Sold or

Acquired or

Total Cost

Value %

Value

Purchase

Capitalized Cost

Discarded(-)

Transferred(+)

2003 & Prior

20%

2004

30%

2005

40%

2006

50%

2007

60%

2008

70%

2009 *

80%

Total

B: Computer Assets

A

B

C

D = A-B+C

E

F = D x E

Year of

Original

Sold or

Acquired or

Value

Total Cost

Value

Purchase

Capitalized Cost

Discarded(-)

Transferred(+)

%

2006 & Prior

10%

2007

30%

2008

45%

2009 *

65%

Total

Total All

Part III: Leased Assets (attach additional sheets if necessary)

Name of

From

To

Description and

Complete Mailing Address

Original Cost

Owner

mm/dd/yy

mm/dd/yy

Serial Number

Declaration:

I, the undersigned, do affirm that the foregoing information is true and correct to the best of my knowledge.

Print Name: _________________________________________Phone: _________________________________________

Signature:

___________________________________Date: _________ E-mail: ________________________________

** SEE INSTRUCTIONS ON REVERSE **

P/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2