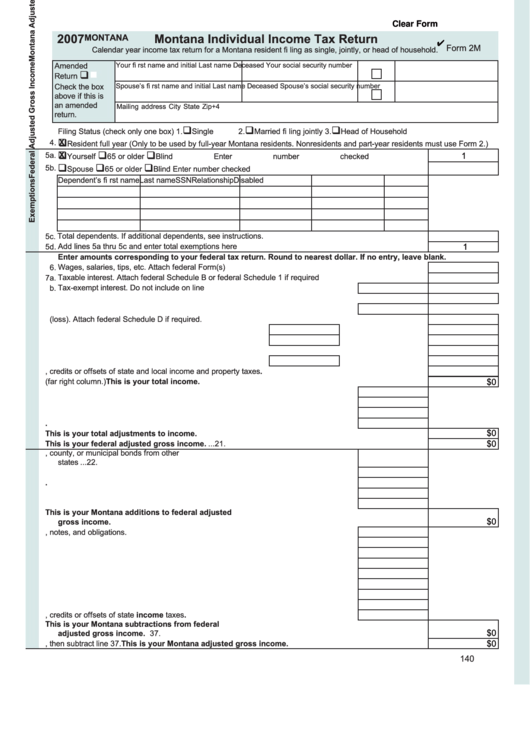

Clear Form

2007

Montana Individual Income Tax Return

MONTANA

Form 2M

Calendar year income tax return for a Montana resident fi ling as single, jointly, or head of household.

Your fi rst name and initial

Last name

Deceased Your social security number

Amended

Return

Spouse’s fi rst name and initial

Last name

Deceased Spouse’s social security number

Check the box

above if this is

an amended

Mailing address

City

State

Zip+4

return.

Filing Status (check only one box)

1.

Single

2.

Married fi ling jointly

3.

Head of Household

X

4.

Resident full year (Only to be used by full-year Montana residents. Nonresidents and part-year residents must use Form 2.)

1

X

5a.

Yourself

65 or older

Blind

Enter number checked ................................5a.

5b.

Spouse

65 or older

Blind

Enter number checked ................................5b.

Dependent’s fi rst name

Last name

SSN

Relationship

Disabled

5c. Total dependents. If additional dependents, see instructions. ..................................................................... 5c.

1

5d. Add lines 5a thru 5c and enter total exemptions here .................................................................................5d.

Enter amounts corresponding to your federal tax return. Round to nearest dollar. If no entry, leave blank.

6. Wages, salaries, tips, etc. Attach federal Form(s) W-2..................................................................................6.

7a. Taxable interest. Attach federal Schedule B or federal Schedule 1 if required ............................................7a.

b. Tax-exempt interest. Do not include on line 7a............................................................7b.

8a. Ordinary dividends. Attach federal Schedule B or federal Schedule 1 if required. ......................................8a.

b. Qualifi ed dividends. .....................................................................................................8b.

9. Capital gain or (loss). Attach federal Schedule D if required. ........................................................................9.

10a. IRA distributions...............................................................10a.

Taxable amount. ......10b.

11a. Pensions and annuities ...................................................11a.

Taxable amount. ......11b.

12. Unemployment compensation. ....................................................................................................................12.

13a. Social security benefi ts. ...................................................13a.

Taxable amount. ......13b.

14. Taxable refunds, credits or offsets of state and local income and property taxes. ......................................14.

$0

15. Add lines 6 through 14 (far right column.) This is your total income. .......................................................15.

16. Educator expenses. .....................................................................................................16.

17. IRA deduction ..............................................................................................................17.

18. Student loan interest deduction ...................................................................................18.

19. Tuition and fees deduction. .........................................................................................19.

$0

20. Add lines 16 through 19 and enter the result here. This is your total adjustments to income. ..............20.

$0

21. Subtract line 20 from line 15 and enter the result here. This is your federal adjusted gross income. ...21.

22. Interest and municipal fund dividends state, county, or municipal bonds from other

states ...........................................................................................................................22.

23. Taxable federal refund. ................................................................................................23.

24. Taxable Montana homeowner property tax refund. .....................................................24.

25. Addition to federal taxable social security/railroad retirement. ....................................25.

26. Medical care savings account nonqualifi ed withdrawal. ..............................................26.

27. Add lines 22 through 26 and enter the result here. This is your Montana additions to federal adjusted

$0

gross income. ............................................................................................................................................27.

28. Exempt interest and dividends from federal bonds, notes, and obligations. ...............28.

29. Exempt unemployment compensation. .......................................................................29.

30. Partial pension and annuity income exemption. ..........................................................30.

31. Partial interest exemption for taxpayers 65 and older. ................................................31.

32. Exemption for certain taxed tips and gratuities............................................................32.

33. Exempt medical care savings account deposits and earnings ....................................33.

34. Subtraction to federal taxable social security/Tier I Railroad Retirement. ...................34.

35. Subtraction for federal taxable Tier II Railroad Retirement..........................................35.

36. Federally taxable refunds, credits or offsets of state income taxes. ...........................36.

37. Add lines 28 through 36 and enter the result here. This is your Montana subtractions from federal

$0

adjusted gross income. ............................................................................................................................37.

$0

38. Add lines 21 and 27, then subtract line 37. This is your Montana adjusted gross income. ...................38.

140

1

1 2

2 3

3 4

4