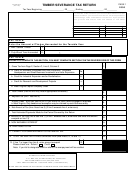

Form Wv/sev-401w - Annual Severance Tax Return - 2003 Page 2

ADVERTISEMENT

PAGE 2

WV/SEV-401W (REV 9/03)

SCHEDULE B SEVERANCE TAX COMPUTATION SCHEDULE

ACCOUNT IDENTIFICATION NUMBER

BUSINESS NAME

(COLUMN 1)

(COLUMN 3)

(COLUMN 2)

TOTAL GROSS VALUE OF RECOVERED AND PROCESSED WASTE COAL

TAX (COL. 1 X COL. 2)

RATE

.025

INSTRUCTIONS AND GENERAL INFORMATION § 11-13A-3e

All persons extracting and processing material from refuse, gob piles or other sources of waste coal and producing coal will be required

to file an annual waste coal severance tax return, form WV/SEV-401W, to report the total tons of waste coal produced, the county in

which the waste coal is recovered, and the total gross income received from the sale of the waste coal. Quarterly estimated tax returns

are required for reporting the two and one-half percent (2.5%) tax on the production of waste coal.

The waste coal tax applies to all persons that both (1) Extract material from coal refuse, gob piles or other sources of waste coal located

in this State, and (2) subsequently process, wash and prepare this extracted and recovered material to produce coal for sale, profit or

commercial use. The tax is in addition to all other taxes imposed by law. Waste coal production remains subject to both the three-cent

per ton reclamation tax and the additional two-cent per ton special tax for the funding of the Department of Environmental Protection.

The new waste coal tax does not apply to any electrical power co-generation plant burning material from its wholly owned refuse or gob

pile.

For waste coal produced or processed prior to tax years beginning on or after April 13, 2001, the applicable tax is the greater of five

percent (5%) of gross receipts or seventy-five cents ($ .75) per ton. Such tax should be included on your monthly and annual coal

severance tax returns. For waste coal produced or processed for tax years beginning on or after April 13, 2001, the applicable tax is two

and one-half percent (2.5%) of gross receipts and the tax is paid and returns are filed quarterly. Example: Calendar year Taxpayers will

continue to pay at the present rate until December 31, 2001. Beginning with January 1, 2002, those calendar year Taxpayers will report

waste coal production at the 2.5% rate on the quarterly returns. The two and one-half percent (2.5%) tax is in lieu of the five percent (5%)

severance tax imposed on coal production and in lieu of the seventy-five cents ($ .75) per ton minimum severance tax imposed on coal

production.

A Taxpayer must be both the extractor and the processor of the coal waste, and the coal waste must be processed into material that is

predominantly coal in order for the activity to qualify for the waste coal severance tax 2.5% rate. Coal waste that is extracted but not

processed, or that is processed into coal by an entity other than the extractor, remains taxable at the 5% of gross receipts or 75 cents per

ton tax rate.

If you file both the waste coal severance tax return, WV/SEV-401W and the coal severance tax return WV/SEV-401C, you may claim

only one $500.00 annual exemption. You may claim the total exemption on one return, or pro-rate the exemption on both returns.

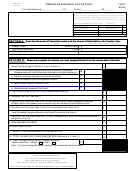

SCHEDULE D - SUBSIDIARIES REPORTED

FEIN

NAME

FEIN

NAME

1.

4.

2.

5.

3.

6.

Please answer all questions:

1. If you purchased this business in the past twelve (12) months, give the previous owner's full name and address:

__________________________________________________________________________________________________________________________________________

2. During the period covered by this return, did you:

a. Quit business?_______________ Sell or otherwise dispose of your business?_______________ Exact date________________________________

b. If business was sold, give exact name and address of new owner______________________________________________________________________

_________________________________________________________________________________________________________________________________________

3. Address where your records are located___________________________________________________________________________________________

4. Principal place of business in West Virginia ________________________________________________________________________________________

5. Nature of business conducted (Describe in Detail)___________________________________________________________________________________

6. Give name and account number of any additional business(es) operated in West Virginia by the reporting taxpayer________________________________

__________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements), and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(Signature of preparer other than taxpayer)

(Address)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2