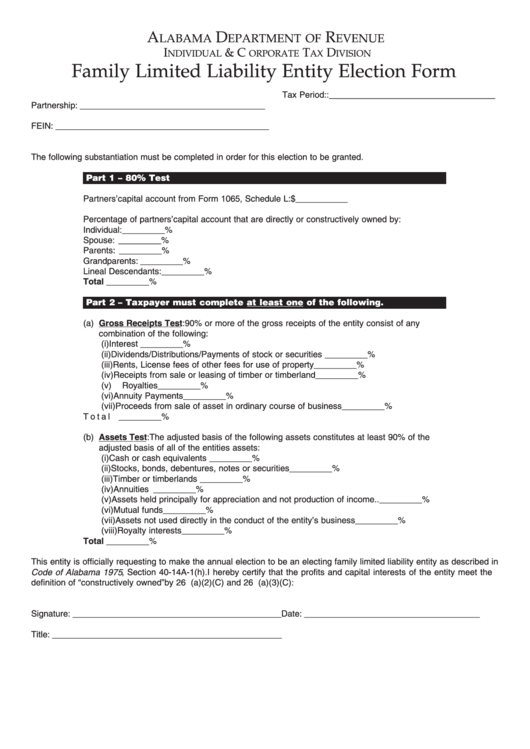

Family Limited Liability Entity Election Form

ADVERTISEMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

Family Limited Liability Entity Election Form

Tax Period:: ___________________________________

Partnership: _______________________________________

FEIN: _____________________________________________

The following substantiation must be completed in order for this election to be granted.

Part 1 – 80% Test

Partners’ capital account from Form 1065, Schedule L:. . . . . . . . . . . . . . . . . . . . . . $___________

Percentage of partners’ capital account that are directly or constructively owned by:

Individual:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Spouse: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Parents: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Grandparents: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Lineal Descendants:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Part 2 – Taxpayer must complete at least one of the following.

(a) Gross Receipts Test: 90% or more of the gross receipts of the entity consist of any

combination of the following:

(i)

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(ii)

Dividends/Distributions/Payments of stock or securities . . . . . . . . . . . . . . _________%

(iii)

Rents, License fees of other fees for use of property . . . . . . . . . . . . . . . . _________%

(iv) Receipts from sale or leasing of timber or timberland . . . . . . . . . . . . . . . . _________%

(v)

Royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(vi) Annuity Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(vii) Proceeds from sale of asset in ordinary course of business . . . . . . . . . . _________%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(b) Assets Test: The adjusted basis of the following assets constitutes at least 90% of the

adjusted basis of all of the entities assets:

(i)

Cash or cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(ii)

Stocks, bonds, debentures, notes or securities. . . . . . . . . . . . . . . . . . . . . . _________%

(iii)

Timber or timberlands . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(iv) Annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(v)

Assets held principally for appreciation and not production of income . . _________%

(vi) Mutual funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

(vii) Assets not used directly in the conduct of the entity’s business . . . . . . . _________%

(viii) Royalty interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________%

This entity is officially requesting to make the annual election to be an electing family limited liability entity as described in

Code of Alabama 1975 , Section 40-14A-1(h). I hereby certify that the profits and capital interests of the entity meet the

definition of “constructively owned” by 26 U.S.C. Section 318(a)(2)(C) and 26 U.S.C. Section 318(a)(3)(C):

Signature: ____________________________________________

Date: _____________________________________

Title: _________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1