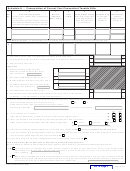

Schedule B – Gifts From Prior Periods

List annual gifts made on or after January 1, 2005, but

before January 1, 2008.

Column A - Calendar Year

Column B - Connecticut Taxable Gifts Column C - Connecticut Gift Tax Paid

00

00

00

00

00

00

00

00

00

00

Column Totals:

00

00

Schedule C – Estate Tax Deduction Computation

1. Allowable estate tax deductions for federal estate tax purposes other than

deduction allowable for state death taxes under I.R.C. §2058 ................................

1.

00

2. Reserved for future use. ..........................................................................................

2.

3. Deduction for transfers to civil union partners .........................................................

3.

00

4. Add Line 1 and Line 3. Enter here and on Section 2, Line 6. .................................

4.

00

Qualified Terminable Interest Property (QTIP) Questions

Yes

No

5. Was an election made for federal estate tax purposes to have a trust or other property of the decedent’s

gross estate treated as QTIP under I.R.C. §2056(b)(7)? ......................................................................................

6. If no election was made for federal estate tax purposes to have a trust or other property of the decedent’s

gross estate treated as QTIP, is a I.R.C. §2056(b)(7) election being made to have the trust or other

property treated as QTIP for Connecticut estate tax purposes? See instructions on Page 19. ...........................

7. Does the decedent’s gross estate, for federal estate tax purposes, contain any I.R.C. §2044 property

(QTIP from a prior gift or estate)? .........................................................................................................................

8. If the decedent’s gross estate, for federal estate tax purposes, does not contain any I.R.C. §2044

property from a prior gift or estate, does the decedent’s gross estate, for Connecticut estate tax purposes,

contain any I.R.C. §2044 property from a prior estate that made a I.R.C. §2056(b)(7) election for

Connecticut estate tax purposes? .........................................................................................................................

Estates continue to Page 4.

Go To Page 4

Form CT-706/709 (Rev. 9/08)

Page 3 of 4

1

1 2

2 3

3 4

4