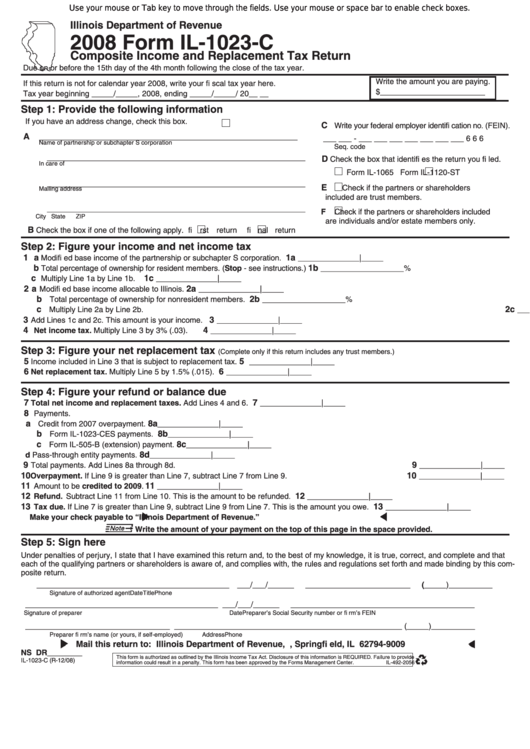

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2008 Form IL-1023-C

Composite Income and Replacement Tax Return

Due on or before the 15th day of the 4th month following the close of the tax year.

Write the amount you are paying.

If this return is not for calendar year 2008, write your fi scal tax year here.

$________________________

Tax year beginning _____/_____, 2008, ending _____/_____/ 20__ __

Step 1: Provide the following information

If you have an address change, check this box.

C

Write your federal employer identifi cation no. (FEIN).

A

___________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

6 6 6

Name of partnership or subchapter S corporation

Seq. code

___________________________________________________________

D

Check the box that identifi es the return you fi led.

In care of

Form IL-1065

Form IL-1120-ST

___________________________________________________________

E

Check if the partners or shareholders

Mailing address

included are trust members.

___________________________________________________________

F

Check if the partners or shareholders included

City

State

ZIP

are individuals and/or estate members only.

B

Check the box if one of the following apply.

fi rst return

fi nal return

Step 2: Figure your income and net income tax

1 a

1a

Modifi ed base income of the partnership or subchapter S corporation.

______________|_____

b

1b

Total percentage of ownership for resident members. (Stop - see instructions.)

___________________%

c

1c

Multiply Line 1a by Line 1b.

______________|_____

2 a

2a

Modifi ed base income allocable to Illinois.

______________|_____

b

2b

Total percentage of ownership for nonresident members.

___________________%

c

2c

Multiply Line 2a by Line 2b.

______________|_____

3

3

Add Lines 1c and 2c. This amount is your income.

______________|_____

4

4

Net income tax. Multiply Line 3 by 3% (.03).

______________|_____

Step 3: Figure your net replacement tax

(Complete only if this return includes any trust members.)

5

5

Income included in Line 3 that is subject to replacement tax.

______________|_____

6

6

Net replacement tax. Multiply Line 5 by 1.5% (.015).

______________|_____

Step 4: Figure your refund or balance due

7

7

Total net income and replacement taxes. Add Lines 4 and 6.

______________|_____

8

Payments.

a

8a

Credit from 2007 overpayment.

______________|_____

b

8b

Form IL-1023-CES payments.

______________|_____

c

8c

Form IL-505-B (extension) payment.

______________|_____

8d

d Pass-through entity payments.

______________|_____

9

9

Total payments. Add Lines 8a through 8d.

______________|_____

10

10

Overpayment. If Line 9 is greater than Line 7, subtract Line 7 from Line 9.

______________|_____

11

11

Amount to be credited to 2009.

______________|_____

12

12

Refund. Subtract Line 11 from Line 10. This is the amount to be refunded.

______________|_____

13

13

Tax due. If Line 7 is greater than Line 9, subtract Line 9 from Line 7. This is the amount you owe.

______________|_____

Make your check payable to “Illinois Department of Revenue.”

Write the amount of your payment on the top of this page in the space provided.

Step 5: Sign here

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete and that

each of the qualifying partners or shareholders is aware of, and complies with, the rules and regulations set forth and made binding by this com-

posite return.

____________________________________________

___/___/______

________________________ (_____)__________

Signature of authorized agent

Date

Title

Phone

____________________________________________

___/___/______

__________________________________________

Signature of preparer

Date

Preparer’s Social Security number or fi rm’s FEIN

_________________________________ ____________________________________________________

(_____)__________

Preparer fi rm’s name (or yours, if self-employed)

Address

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19009, Springfi eld, IL 62794-9009

NS DR________

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

IL-1023-C (R-12/08)

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2056

1

1 2

2