Form 2006 Ri-1040x - Amended Rhode Island Individual Income Tax Return Instructions - Rhose Island

ADVERTISEMENT

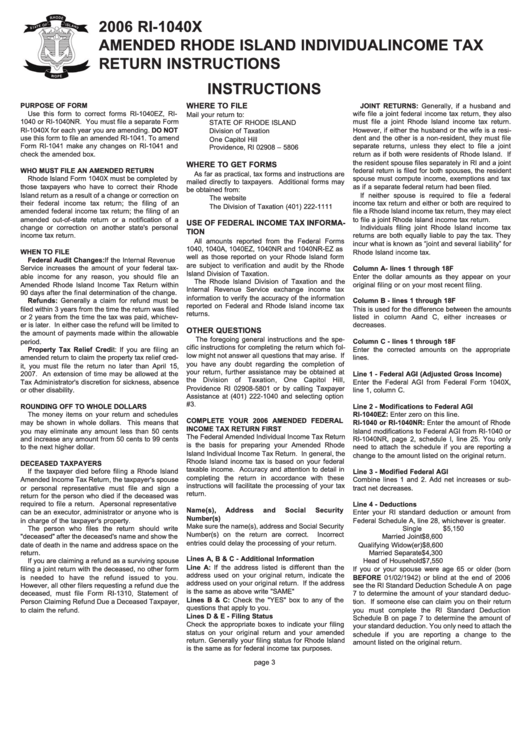

2006 RI-1040X

AMENDED RHODE ISLAND INDIVIDUAL INCOME TAX

RETURN INSTRUCTIONS

INSTRUCTIONS

PURPOSE OF FORM

WHERE TO FILE

JOINT RETURNS: Generally, if a husband and

Use this form to correct forms RI-1040EZ, RI-

wife file a joint federal income tax return, they also

Mail your return to:

1040 or RI-1040NR. You must file a separate Form

must file a joint Rhode Island income tax return.

STATE OF RHODE ISLAND

RI-1040X for each year you are amending. DO NOT

However, if either the husband or the wife is a resi-

Division of Taxation

use this form to file an amended RI-1041. To amend

dent and the other is a non-resident, they must file

One Capitol Hill

Form RI-1041 make any changes on RI-1041 and

separate returns, unless they elect to file a joint

Providence, RI 02908 – 5806

check the amended box.

return as if both were residents of Rhode Island. If

the resident spouse files separately in RI and a joint

WHERE TO GET FORMS

WHO MUST FILE AN AMENDED RETURN

federal return is filed for both spouses, the resident

As far as practical, tax forms and instructions are

Rhode Island Form 1040X must be completed by

spouse must compute income, exemptions and tax

mailed directly to taxpayers. Additional forms may

those taxpayers who have to correct their Rhode

as if a separate federal return had been filed.

be obtained from:

Island return as a result of a change or correction on

If neither spouse is required to file a federal

The website

their federal income tax return; the filing of an

income tax return and either or both are required to

The Division of Taxation (401) 222-1111

amended federal income tax return; the filing of an

file a Rhode Island income tax return, they may elect

amended out-of-state return or a notification of a

to file a joint Rhode Island income tax return.

USE OF FEDERAL INCOME TAX INFORMA-

change or correction on another state's personal

Individuals filing joint Rhode Island income tax

TION

income tax return.

returns are both equally liable to pay the tax. They

All amounts reported from the Federal Forms

incur what is known as “joint and several liability” for

1040, 1040A, 1040EZ, 1040NR and 1040NR-EZ as

WHEN TO FILE

Rhode Island income tax.

well as those reported on your Rhode Island form

Federal Audit Changes: If the Internal Revenue

are subject to verification and audit by the Rhode

Service increases the amount of your federal tax-

Column A - lines 1 through 18F

Island Division of Taxation.

able income for any reason, you should file an

Enter the dollar amounts as they appear on your

The Rhode Island Division of Taxation and the

Amended Rhode Island Income Tax Return within

original filing or on your most recent filing.

Internal Revenue Service exchange income tax

90 days after the final determination of the change.

information to verify the accuracy of the information

Refunds: Generally a claim for refund must be

Column B - lines 1 through 18F

reported on Federal and Rhode Island income tax

filed within 3 years from the time the return was filed

This is used for the difference between the amounts

returns.

or 2 years from the time the tax was paid, whichev-

listed in column A and C, either increases or

er is later. In either case the refund will be limited to

decreases.

OTHER QUESTIONS

the amount of payments made within the allowable

The foregoing general instructions and the spe-

period.

Column C - lines 1 through 18F

cific instructions for completing the return which fol-

Property Tax Relief Credit: If you are filing an

Enter the corrected amounts on the appropriate

low might not answer all questions that may arise. If

amended return to claim the property tax relief cred-

lines.

you have any doubt regarding the completion of

it, you must file the return no later than April 15,

your return, further assistance may be obtained at

2007. An extension of time may be allowed at the

Line 1 - Federal AGI (Adjusted Gross Income)

the Division of Taxation, One Capitol Hill,

Tax Administrator's discretion for sickness, absence

Enter the Federal AGI from Federal Form 1040X,

Providence RI 02908-5801 or by calling Taxpayer

or other disability.

line 1, column C.

Assistance at (401) 222-1040 and selecting option

#3.

ROUNDING OFF TO WHOLE DOLLARS

Line 2 - Modifications to Federal AGI

The money items on your return and schedules

RI-1040EZ: Enter zero on this line.

COMPLETE YOUR 2006 AMENDED FEDERAL

may be shown in whole dollars. This means that

RI-1040 or RI-1040NR: Enter the amount of Rhode

INCOME TAX RETURN FIRST

you may eliminate any amount less than 50 cents

Island modifications to Federal AGI from RI-1040 or

The Federal Amended Individual Income Tax Return

and increase any amount from 50 cents to 99 cents

RI-1040NR, page 2, schedule I, line 25. You only

is the basis for preparing your Amended Rhode

to the next higher dollar.

need to attach the schedule if you are reporting a

Island Individual Income Tax Return. In general, the

change to the amount listed on the original return.

Rhode Island income tax is based on your federal

DECEASED TAXPAYERS

taxable income. Accuracy and attention to detail in

If the taxpayer died before filing a Rhode Island

Line 3 - Modified Federal AGI

completing the return in accordance with these

Amended Income Tax Return, the taxpayer's spouse

Combine lines 1 and 2. Add net increases or sub-

instructions will facilitate the processing of your tax

or personal representative must file and sign a

tract net decreases.

return.

return for the person who died if the deceased was

required to file a return. A personal representative

Line 4 - Deductions

Name(s),

Address

and

Social

Security

can be an executor, administrator or anyone who is

Enter your RI standard deduction or amount from

Number(s)

in charge of the taxpayer's property.

Federal Schedule A, line 28, whichever is greater.

Make sure the name(s), address and Social Security

The person who files the return should write

Single

$5,150

Number(s) on the return are correct.

Incorrect

"deceased" after the deceased's name and show the

Married Joint

$8,600

entries could delay the processing of your return.

date of death in the name and address space on the

Qualifying Widow(er)

$8,600

return.

Married Separate

$4,300

Lines A, B & C - Additional Information

If you are claiming a refund as a surviving spouse

Head of Household

$7,550

Line A: If the address listed is different than the

filing a joint return with the deceased, no other form

If you or your spouse were age 65 or older (born

address used on your original return, indicate the

is needed to have the refund issued to you.

BEFORE 01/02/1942) or blind at the end of 2006

address used on your original return. If the address

However, all other filers requesting a refund due the

see the RI Standard Deduction Schedule A on page

is the same as above write "SAME"

deceased, must file Form RI-1310, Statement of

7 to determine the amount of your standard deduc-

Lines B & C: Check the "YES" box to any of the

Person Claiming Refund Due a Deceased Taxpayer,

tion. If someone else can claim you on their return

questions that apply to you.

to claim the refund.

you must complete the RI Standard Deduction

Lines D & E - Filing Status

Schedule B on page 7 to determine the amount of

Check the appropriate boxes to indicate your filing

your standard deduction. You only need to attach the

status on your original return and your amended

schedule if you are reporting a change to the

return. Generally your filing status for Rhode Island

amount listed on the original return.

is the same as for federal income tax purposes.

page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5