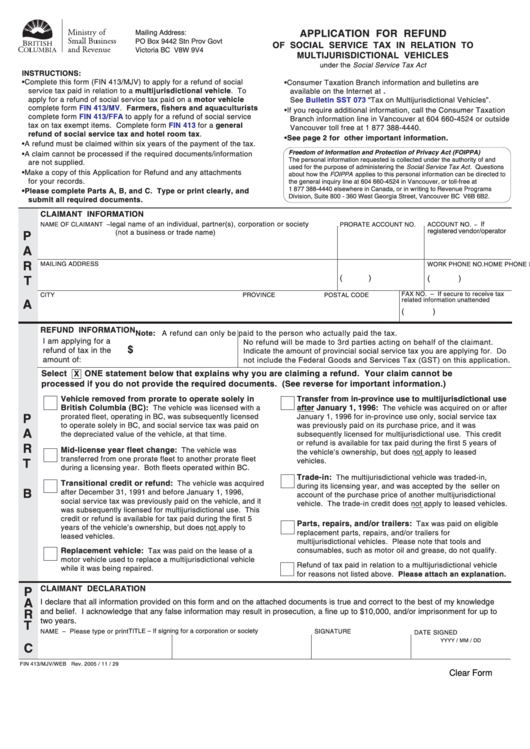

APPLICATION FOR REFUND

Mailing Address:

PO Box 9442 Stn Prov Govt

OF SOCIAL SERVICE TAX IN RELATION TO

Victoria BC V8W 9V4

MULTIJURISDICTIONAL VEHICLES

under the Social Service Tax Act

INSTRUCTIONS:

• Complete this form (FIN 413/MJV) to apply for a refund of social

• Consumer Taxation Branch information and bulletins are

service tax paid in relation to a multijurisdictional vehicle. To

available on the Internet at

.

apply for a refund of social service tax paid on a motor vehicle

See

Bulletin SST 073

“Tax on Multijurisdictional Vehicles”.

complete form

FIN

413/MV. Farmers, fishers and aquaculturists

• If you require additional information, call the Consumer Taxation

complete form

FIN 413/FFA

to apply for a refund of social service

Branch information line in Vancouver at 604 660-4524 or outside

tax on tax exempt items. Complete form

FIN 413

for a general

Vancouver toll free at 1 877 388-4440.

refund of social service tax and hotel room tax.

• See page 2 for other important information.

• A refund must be claimed within six years of the payment of the tax.

Freedom of Information and Protection of Privacy Act (FOIPPA)

• A claim cannot be processed if the required documents/information

The personal information requested is collected under the authority of and

are not supplied.

used for the purpose of administering the Social Service Tax Act . Questions

• Make a copy of this Application for Refund and any attachments

about how the FOIPPA applies to this personal information can be directed to

for your records.

the general inquiry line at 604 660-4524 in Vancouver, or toll-free at

1 877 388-4440 elsewhere in Canada, or in writing to Revenue Programs

• Please complete Parts A, B, and C. Type or print clearly, and

Division, Suite 800 - 360 West Georgia Street, Vancouver BC V6B 6B2.

submit all required documents.

CLAIMANT INFORMATION

legal name of an individual, partner(s), corporation or society

If

NAME OF CLAIMANT –

ACCOUNT NO.

PRORATE ACCOUNT NO.

–

registered vendor/operator

(not a business or trade name)

P

A

R

MAILING ADDRESS

HOME PHONE NO.

WORK PHONE NO.

(

)

(

)

T

FAX NO. – If secure to receive tax

CITY

PROVINCE

POSTAL CODE

related information unattended

A

(

)

REFUND INFORMATION

Note: A refund can only be paid to the person who actually paid the tax.

I am applying for a

No refund will be made to 3rd parties acting on behalf of the claimant.

$

refund of tax in the

Indicate the amount of provincial social service tax you are applying for. Do

amount of:

not include the Federal Goods and Services Tax (GST) on this application.

Select

ONE statement below that explains why you are claiming a refund. Your claim cannot be

X

processed if you do not provide the required documents. (See reverse for important information.)

Vehicle removed from prorate to operate solely in

Transfer from in-province use to multijurisdictional use

British Columbia (BC):

after January 1, 1996:

The vehicle was licensed with a

The vehicle was acquired on or after

P

prorated fleet, operating in BC, was subsequently licensed

January 1, 1996 for in-province use only, social service tax

to operate solely in BC, and social service tax was paid on

was previously paid on its purchase price, and it was

A

the depreciated value of the vehicle, at that time.

subsequently licensed for multijurisdictional use. This credit

or refund is available for tax paid during the first 5 years of

R

Mid-license year fleet change:

The vehicle was

the vehicle’s ownership, but does not apply to leased

transferred from one prorate fleet to another prorate fleet

vehicles.

T

during a licensing year. Both fleets operated within BC.

Trade-in:

The multijurisdictional vehicle was traded-in,

Transitional credit or refund:

The vehicle was acquired

during its licensing year, and was accepted by the seller on

B

after December 31, 1991 and before January 1, 1996,

account of the purchase price of another multijurisdictional

social service tax was previously paid on the vehicle, and it

vehicle. The trade-in credit does not apply to leased vehicles.

was subsequently licensed for multijurisdictional use. This

credit or refund is available for tax paid during the first 5

Parts, repairs, and/or trailers:

Tax was paid on eligible

years of the vehicle’s ownership, but does not apply to

replacement parts, repairs, and/or trailers for

leased vehicles.

multijurisdictional vehicles. Please note that tools and

Replacement vehicle:

Tax was paid on the lease of a

consumables, such as motor oil and grease, do not qualify.

motor vehicle used to replace a multijurisdictional vehicle

Refund of tax paid in relation to a multijurisdictional vehicle

while it was being repaired.

for reasons not listed above. Please attach an explanation.

CLAIMANT DECLARATION

P

A

I declare that all information provided on this form and on the attached documents is true and correct to the best of my knowledge

and belief. I acknowledge that any false information may result in prosecution, a fine up to $10,000, and/or imprisonment for up to

R

two years.

T

TITLE – If signing for a corporation or society

NAME –

Please type or print

SIGNATURE

DATE SIGNED

YYYY / MM / DD

C

FIN 413/MJV/WEB Rev. 2005 / 11 / 29

Clear Form

1

1 2

2