Instructions For Preparing Annual Report Of Project (Form Ar) - Alabama Department Of Revenue 2007

ADVERTISEMENT

Form AR

12/97

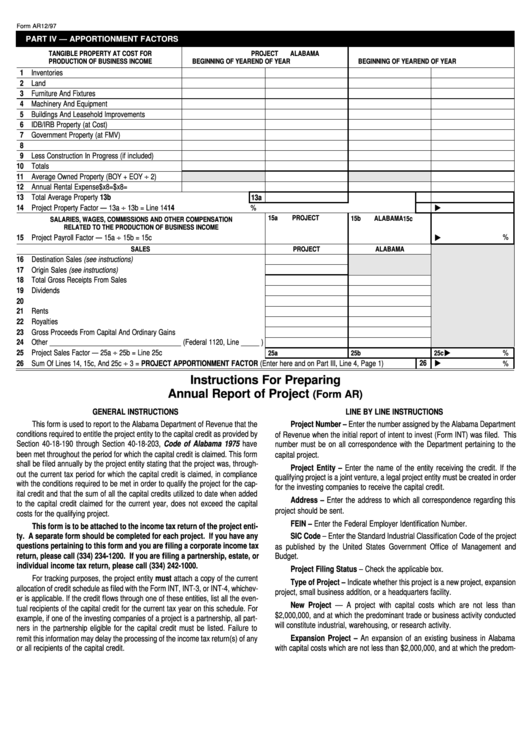

PART IV — APPORTIONMENT FACTORS

TANGIBLE PROPERTY AT COST FOR

PROJECT

ALABAMA

PRODUCTION OF BUSINESS INCOME

BEGINNING OF YEAR

END OF YEAR

BEGINNING OF YEAR

END OF YEAR

1 Inventories

2 Land

3 Furniture And Fixtures

4 Machinery And Equipment

5 Buildings And Leasehold Improvements

6 IDB/IRB Property (at Cost)

7 Government Property (at FMV)

8

9 Less Construction In Progress (if included)

10 Totals

11 Average Owned Property (BOY + EOY ÷ 2)

12 Annual Rental Expense

$

x8 =

$

x8 =

13 Total Average Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13a

. . . . . . . . . . . . . . . . . . . . 13b

14 Project Property Factor — 13a ÷ 13b = Line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

%

15a

PROJECT

15b

ALABAMA

15c

SALARIES, WAGES, COMMISSIONS AND OTHER COMPENSATION

RELATED TO THE PRODUCTION OF BUSINESS INCOME

15 Project Payroll Factor — 15a ÷ 15b = 15c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

SALES

PROJECT

ALABAMA

16 Destination Sales (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Origin Sales (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Total Gross Receipts From Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21 Rents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23 Gross Proceeds From Capital And Ordinary Gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24 Other ____________________________________ (Federal 1120, Line _____ )

25 Project Sales Factor — 25a ÷ 25b = Line 25c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

25a

25b

25c

26 Sum Of Lines 14, 15c, And 25c ÷ 3 = PROJECT APPORTIONMENT FACTOR (Enter here and on Part III, Line 4, Page 1) . . . . . . . . . .

26

%

Instructions For Preparing

Annual Report of Project

(Form AR)

GENERAL INSTRUCTIONS

LINE BY LINE INSTRUCTIONS

This form is used to report to the Alabama Department of Revenue that the

Project Number – Enter the number assigned by the Alabama Department

conditions required to entitle the project entity to the capital credit as provided by

of Revenue when the initial report of intent to invest (Form INT) was filed. This

Section 40-18-190 through Section 40-18-203, Code of Alabama 1975 have

number must be on all correspondence with the Department pertaining to the

been met throughout the period for which the capital credit is claimed. This form

capital project.

shall be filed annually by the project entity stating that the project was, through-

Project Entity – Enter the name of the entity receiving the credit. If the

out the current tax period for which the capital credit is claimed, in compliance

qualifying project is a joint venture, a legal project entity must be created in order

with the conditions required to be met in order to qualify the project for the cap-

for the investing companies to receive the capital credit.

ital credit and that the sum of all the capital credits utilized to date when added

Address – Enter the address to which all correspondence regarding this

to the capital credit claimed for the current year, does not exceed the capital

project should be sent.

costs for the qualifying project.

FEIN – Enter the Federal Employer Identification Number.

This form is to be attached to the income tax return of the project enti-

ty. A separate form should be completed for each project. If you have any

SIC Code – Enter the Standard Industrial Classification Code of the project

questions pertaining to this form and you are filing a corporate income tax

as published by the United States Government Office of Management and

return, please call (334) 234-1200. If you are filing a partnership, estate, or

Budget.

individual income tax return, please call (334) 242-1000.

Project Filing Status – Check the applicable box.

For tracking purposes, the project entity must attach a copy of the current

Type of Project – Indicate whether this project is a new project, expansion

allocation of credit schedule as filed with the Form INT, INT-3, or INT-4, whichev-

project, small business addition, or a headquarters facility.

er is applicable. If the credit flows through one of these entities, list all the even-

New Project –– A project with capital costs which are not less than

tual recipients of the capital credit for the current tax year on this schedule. For

$2,000,000, and at which the predominant trade or business activity conducted

example, if one of the investing companies of a project is a partnership, all part-

will constitute industrial, warehousing, or research activity.

ners in the partnership eligible for the capital credit must be listed. Failure to

remit this information may delay the processing of the income tax return(s) of any

Expansion Project – An expansion of an existing business in Alabama

or all recipients of the capital credit.

with capital costs which are not less than $2,000,000, and at which the predom-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3