Instructions For Preparing Annual Report U-R1 - Railroad - Class 1 - 2002

ADVERTISEMENT

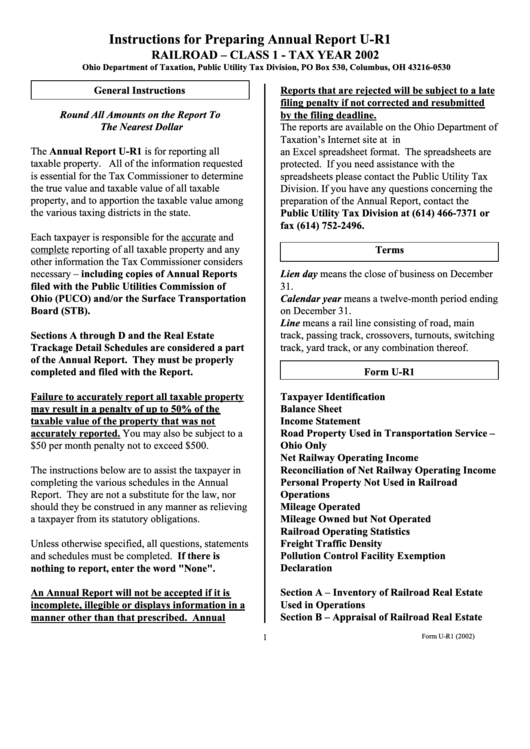

Instructions for Preparing Annual Report U-R1

RAILROAD – CLASS 1 - TAX YEAR 2002

Ohio Department of Taxation, Public Utility Tax Division, PO Box 530, Columbus, OH 43216-0530

General Instructions

Reports that are rejected will be subject to a late

filing penalty if not corrected and resubmitted

Round All Amounts on the Report To

by the filing deadline.

The Nearest Dollar

The reports are available on the Ohio Department of

Taxation’s Internet site at in

The Annual Report U-R1 is for reporting all

an Excel spreadsheet format. The spreadsheets are

taxable property. All of the information requested

protected. If you need assistance with the

is essential for the Tax Commissioner to determine

spreadsheets please contact the Public Utility Tax

the true value and taxable value of all taxable

Division. If you have any questions concerning the

property, and to apportion the taxable value among

preparation of the Annual Report, contact the

the various taxing districts in the state.

Public Utility Tax Division at (614) 466-7371 or

fax (614) 752-2496.

Each taxpayer is responsible for the accurate and

complete reporting of all taxable property and any

Terms

other information the Tax Commissioner considers

necessary – including copies of Annual Reports

Lien day means the close of business on December

filed with the Public Utilities Commission of

31.

Calendar year means a twelve-month period ending

Ohio (PUCO) and/or the Surface Transportation

Board (STB).

on December 31.

Line means a rail line consisting of road, main

Sections A through D and the Real Estate

track, passing track, crossovers, turnouts, switching

Trackage Detail Schedules are considered a part

track, yard track, or any combination thereof.

of the Annual Report. They must be properly

completed and filed with the Report.

Form U-R1

Failure to accurately report all taxable property

Taxpayer Identification

may result in a penalty of up to 50% of the

Balance Sheet

taxable value of the property that was not

Income Statement

accurately reported. You may also be subject to a

Road Property Used in Transportation Service –

$50 per month penalty not to exceed $500.

Ohio Only

Net Railway Operating Income

The instructions below are to assist the taxpayer in

Reconciliation of Net Railway Operating Income

completing the various schedules in the Annual

Personal Property Not Used in Railroad

Report. They are not a substitute for the law, nor

Operations

should they be construed in any manner as relieving

Mileage Operated

a taxpayer from its statutory obligations.

Mileage Owned but Not Operated

Railroad Operating Statistics

Unless otherwise specified, all questions, statements

Freight Traffic Density

and schedules must be completed. If there is

Pollution Control Facility Exemption

Declaration

nothing to report, enter the word "None".

Section A – Inventory of Railroad Real Estate

An Annual Report will not be accepted if it is

Used in Operations

incomplete, illegible or displays information in a

Section B – Appraisal of Railroad Real Estate

manner other than that prescribed. Annual

1

Form U-R1 (2002)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5