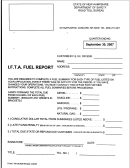

Form Mfd 1-S/af - Motor Fuel & Aviation Fuel Distributor Report - Department Of Safety - New Hampshire Page 2

ADVERTISEMENT

Page 2 MFD 1-S/AF (Revised 03/2010)

NAME:

MONTH OF:

YEAR:

LICENSE NUMBER:

FEIN:

SECTION I

From

AUTOMOTIVE

SPECIAL

AVIATION

JET FUEL

Schedule

GASOLINE

FUEL

GASOLINE

RECEIPTS: (See Instructions)

1. Gallons received from NH licensed distributors in NH for

2

NH bulk storage

2. Gallons received from NH licensed distributors in NH for

2E

export

3. Gallons received from NH licensed distributors in NH

2F

and direct shipped to customers

4. Gallons imported from another state direct to

3

customer

5. Gallons imported from another state into NH bulk

4

storage

6. Total Receipts (Total lines 1 through 5) (Total to Page 1, Line 2)

JET FUEL

SECTION II

From

AUTOMOTIVE

SPECIAL

AVIATION

FAR PART 121

PRIVATE AND

Schedule

GASOLINE

FUEL

GASOLINE

DISBURSEMENTS: (See Instructions)

AIR CARRIERS

COMMERCIAL

1. Gallons delivered – taxable

5

2. Gallons delivered to Air Carriers taxable at

5X

a lower tax rate

3. Gallons delivered to NH licensed distributors

6

4. Gallons of dyed diesel and dyed kerosene

6F

sold for tax exempt purposes

5. Gallons exported

7

6. Gallons delivered to US Gov‟t (Bulk)

8

tax exempt

7. Gallons delivered to State/Local

9

Gov‟t (Bulk) tax exempt

8. Total Disbursements (Total Lines 1 through 7) (Total to

Page 1, Line 4)

9. Total Taxable Gallons (Total Lines 1 through 2) (Total to

Page 1, Line 8)

JET FUEL

SECTION III

From

AUTOMOTIVE

SPECIAL

AVIATION

FAR PART 121

PRIVATE AND

Schedule

GASOLINE

FUEL

GASOLINE

TAX-PAID CREDITS: (See Instructions)

AIR CARRIERS

COMMERCIAL

1. Retail Sales to US Gov‟t and their

13C

agencies

2. Retail Sales to Local or State Gov‟t and their

13H

agencies

3. Retail Sales to State, Local or US Gov‟t and their

13K

agencies at the Air Carriers rate

4. Total tax-paid credits (Total Lines 1 through 3) (Total to

Page 1, Line 9)

MFD 1-S/AF (Revised 03/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10