Form Mfd 1-S/af - Motor Fuel & Aviation Fuel Distributor Report - Department Of Safety - New Hampshire Page 3

ADVERTISEMENT

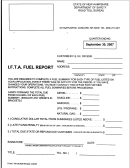

STATE OF NEW HAMPSHIRE MOTOR FUEL & AVIATION FUEL DISTRIBUTOR REPORT INSTRUCTIONS

This form is to be used to report automotive gasoline, undyed special fuel, aviation gasoline and jet fuel transactions. COMPLETE A

SEPARATE SCHEDULE FOR EACH PRODUCT CATEGORY & REPORT WHOLE GALLONS ONLY! If there were no transactions for the

reporting month, write „none‟ on lines 7 and 12. The following items must be completed on the first page of the return: the distributor name,

mailing address, month and year for which the report is filed, telephone number, the NH license number, distributor FEIN, signature, and title of

authorized person and the date signed. The following items must be completed on the second page of the return: the distributor name, month

and year for which the report is filed, the NH license number and the distributor FEIN.

RSA 259:58 Motor Fuel ““Motor Fuel” shall mean all products used in an internal combustion engine for the generation of power to propel

motor vehicles or mechanical contrivances on or over the ways of this state.”

RSA 259:37-b Gasoline ““Gasoline” shall mean all products commonly or commercially known or sold as gasoline, including casing head and

absorption of natural gasoline, regardless of their classification or uses, and any liquid prepared, advertised, offered for sale, or sold for use as

or commonly and commercially used as a fuel in internal combustion engines…”

RSA 259:103-a Special Fuel ““Special Fuel” shall mean all products, except gasoline, propane, natural gas, or liquefied natural gas, used in

an internal combustion engine for the generation of power to propel motor vehicles or mechanical contrivances on or over the ways.””

RSA 422:34 Airways Toll

I. “There is hereby imposed an airways toll of $.04 per gallon upon the sale of each gallon of motor fuel or fuel, as defined by RSA

259:58, sold to and used in the propulsion of aircraft. The airways toll shall be subject to the exemptions provided for government sales

by RSA 260:32.

II. There is hereby imposed an airways toll of $.02 per gallon on the sale of each gallon of aviation jet fuel sold and used in the propulsion

of aircraft. All aircraft, however, that are certified to operate under part 121 of the rules and regulations of the Federal Aviation

Administration shall pay an airways toll of $.005 per gallon on aviation jet fuel sold and used in the propulsion of aircraft.”

INVENTORIES, RECEIPTS & DISBURSEMENTS

LINE 1

Enter the physical quantity of motor fuel and/or aviation fuel gallons contained in transit & in NH wholesale bulk storage at month‟s

beginning. This does not include any product contained in a facility which is attached to a pump used for „retail‟ sale to the public; or

product on consignment to a retail dealer or in a retail station.

LINE 2

Enter total receipts by product category as totaled in Page2, Section I, Line 6.

LINE 3

Enter gallons of biodiesel refined, distilled, blended or manufactured.

LINE 4

Enter total disbursements by product category as totaled in Page 2, Section II, Line 8.

LINE 5

List any inventory transfers between products.

LINE 6

Calculate the inventory gain or loss by product category as: Line 7 – (Line 1 + Line 2 + Line 3 – Line 4 + Line 5)

LINE 7

Enter the physical quantity of motor fuel and/or aviation fuel gallons contained in transit & in NH wholesale bulk storage at month‟s

end. This does not include any product contained in a facility which is attached to a pump used for „retail‟ sale to the public; or

product on consignment to a retail dealer or in a retail station.

TAX COMPUTATION

LINE 8

Enter taxable gallons by product category as reported in Page 2, Section II, Line 9.

LINE 9

Enter gallons of tax-paid credits by product category as reported in Page 2, Section III, Line 4.

LINE 10

Calculate the net taxable gallons by subtracting Line 9 from Line 8.

LINE 11

This is the current tax rate per gallon by product category.

LINE 12

Calculate the tax due by product by multiplying the gallons shown on Line 10 by the tax rate on Line 11.

TOTAL TAX DUE

LINE 13

Calculate the total tax due by summing values from all columns in Line 12.

LINE 14

Failure to file by the required date or to enclose fees due shall result in the assessment of a 10 percent penalty to be added to the

amount of fees due for that month. The 10 percent penalty is calculated from the total dollars due in Line 13. If no fees are due, a

penalty of $1 per day shall be assessed.

LINE 15

Interest is charged based upon the sum of total dollars due (Line 13) and penalty assessed (Line 14).

LINE 16

Add lines 13, 14 and 15 to compute the total dollars due or (refund) including any penalty or interest.

MFD 1-S/AF (Revised 03/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10