Instructions For Form Tp-215 - Application For Registration As A Distributor Of Alcoholic Beverages Page 2

ADVERTISEMENT

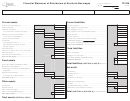

TP-215-

I

(8/05) (back)

Item 8 — Enter your federal employer identification number

Item 16 — This application will not be approved unless you

(EIN). If you do not have one, enter N/A.

have a license issued by the State Liquor Authority (SLA). If you

do not have a license, contact the nearest SLA office:

Item 9 — If you have a second EIN, enter it here. If you do not

Upstate (518) 474-7604

have a second EIN, enter N/A.

Downstate (212) 961-8385

Item 10 — Check the type of business organization that applies.

An out-of-state winery applying for a direct shipper’s license

Item 11 — Enter the required information for:

from the SLA should direct questions to the Albany office only.

— All officers, directors, and shareholders who own or control

Please call the SLA at (518) 474-7604 or (518) 474-3114.

(directly or indirectly) more than 10% of the voting stock

Item 17 — Check the appropriate box or boxes for each type of

(if there are four or fewer shareholders, list only those

business for which you hold an SLA license.

shareholders owning 25% or more of the voting stock). Also,

if the business is owned directly or indirectly by a corporation,

Item 18 — Enter the name and address of each of your

provide a list of the individuals whose ownership of the

alcoholic beverages suppliers.

corporation equals more than 10% (25% or more if there are

Item 19 — Indicate the quantity of beverages you expect to sell

four or fewer shareholders).

per month.

— All partners. Identify general partners as GP after their

Item 20 — Answer Yes or No. If Yes, complete the information

names and limited partners as LP after their names.

for each business.

— The sole proprietor.

Item 21 — Answer Yes or No. If Yes, complete the information

— All employees responsible for the duties specified under

for the applicant, the person listed in item 11, or the business

letters a through g below.

listed in item 20.

In the Duties (a-g) box, use the letters a through g to indicate if

Certification

the individual has final authority for the following:

This application must be signed by the owner, partner, corporate

a. signing checks on the business’s bank account

officer, or other person assuming responsibility for the validity of

b. signing the business’s tax returns

the information contained in the application. If the application is

not signed, it will be returned. Keep a copy for your records.

c. paying creditors

d. making the final decision on which bills are to be paid

Privacy notification

e. conducting the business’s general financial affairs

The Commissioner of Taxation and Finance may collect and

f. filing returns or paying taxes imposed under Article 18 of

maintain personal information pursuant to the New York State

the Tax Law

Tax Law, including but not limited to, sections 171, 171-a, 287,

308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and

g. complying with any other requirement of the Tax Law

may require disclosure of social security numbers pursuant to

Item 12 — Enter the percentage of voting stock held by

42 USC 405(c)(2)(C)(i).

shareholders other than those listed in item 11. The total of the

This information will be used to determine and administer tax

percentages listed in items 11 and 12 must equal 100% of the

liabilities and, when authorized by law, for certain tax offset and

stock ownership.

exchange of tax information programs as well as for any other

lawful purpose.

Item 13 — Enter the complete name and address of banking

institutions with which your business maintains or will maintain

Information concerning quarterly wages paid to employees

accounts. Attach additional sheets if necessary.

is provided to certain state agencies for purposes of fraud

prevention, support enforcement, evaluation of the effectiveness

Item 14 — You must be registered as a sales tax vendor. This

of certain employment and training programs and other

application will not be approved unless you are registered for

purposes authorized by law.

sales tax purposes. If you are not currently registered, submit a

completed Form DTF-17, Application for Registration as a Sales

Failure to provide the required information may subject you to

Tax Vendor, with this application.

civil or criminal penalties, or both, under the Tax Law.

Item 15 — Indicate all other registrations and tax accounts your

business currently has with New York State.

Need help?

Hotline for the hearing and speech impaired:

Internet access:

If you have access to a telecommunications device

(for information, forms, and publications)

for the deaf (TDD), contact us at 1 800 634-2110. If

you do not own a TDD, check with independent living

Fax-on-demand forms: Forms are

centers or community action programs to find out

available 24 hours a day,

where machines are available for public use.

7 days a week.

1 800 748-3676

Persons with disabilities: In compliance with the

Telephone assistance is available from 8:00

to

A.M.

Americans with Disabilities Act, we will ensure that

5:00

(eastern time), Monday through Friday.

P.M.

our lobbies, offices, meeting rooms, and other facilities

To order forms and publications:

1 800 462-8100

are accessible to persons with disabilities. If you have

questions about special accommodations for persons

Business Tax Information Center:

1 800 972-1233

with disabilities, please call 1 800 972-1233.

From areas outside the U.S. and

outside Canada:

(518) 485-6800

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2