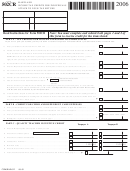

2003 MARYLAND FORM 502CR

PAGE 2

PART E - LONG-TERM CARE INSURANCE CREDIT

Complete Columns A through D. Answer questions and see instructions below before completing Column E.

Column A

Column B

Column C

Column D

Column E

Name and Age of Insured

Social Security No. of Insured

Relationship to Taxpayer

Amount of Premium Paid

Credit Amount

1.

1.

2.

2.

3.

3.

4.

4.

5. TOTAL

5.

Question 1 - Did any of the above-named insured individuals have long-term care insurance prior to July 1, 2000?

Yes

No

Question 2 - Is the credit being claimed for any of the above-named insured individuals in this year by any other taxpayer?

Yes

No

Question 3 - Is the credit being claimed for any of the above-named insured individuals in any other tax year?

Yes

No

If you answered yes to any of the above questions, enter “0” in Column E for that insured person

Unless you have already entered zero, enter in Column E the lesser of the amount of premium paid for each insured or:

$250 for those insured that are under the age of 41;

$470 for those insured that are age 41 to 50; and

$500 for those insured that are over age 50.

Add the amounts in Column E and enter the total on line 5 (TOTAL) and line 5 of Part H, below.

PART F - CREDIT FOR PRESERVATION AND CONSERVATION EASEMENTS

1

1.

Enter the total of the current year donation amount, and any carryover from prior year(s) . . . . . . . . . . . . . . . . . . . . . .

2

2.

Enter the amount of any payment received for the easement during 2003. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Enter the amount from line 24 of Form 502, line 32 of Form 505 or line 33 of Form 515, or $5,000, whichever is less .

5

5.

Enter the lesser of lines 3 or 4 here and on line 6 of Part H below. (If you itemize deductions, see Instruction 14.) . .

6

6.

Excess credit carryover. Subtract line 5 from line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART G - CLEAN ENERGY INCENTIVE CREDIT FOR PHOTOVOLTAIC AND SOLAR WATER HEATING PROPERTY

1

1.

Enter 15% of the cost of photovoltaic property (may not exceed $2,000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2.

Enter 15% of the cost of solar water heating property (may not exceed $1,000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

Total (Add lines 1 and 2.) Enter here and on line 7 of Part H below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART H - PERSONAL INCOME TAX CREDIT SUMMARY

1

1.

Enter the amount from Part A, line 8 (If more than one state, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2.

Enter the amount from Part B, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

Enter the amount from Part C, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Enter the amount from Part D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5.

amount from Part E, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the

6

6.

Enter the amount from Part F, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7.

Enter the amount from Part G, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8.

Enter the amount from Section 2, line 4 of Form 502H. Attach Form 502H. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9.

Total (Add lines 1 through 8.) Enter this amount on line 27 of Form 502, line 35 of Form 505 or line 36 of Form 515

PART J - REFUNDABLE PERSONAL INCOME TAX CREDITS

1

1.

Neighborhood Stabilization Credit. Enter the amount and attach certification. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2.

Heritage Structure Rehabilitation Tax Credit (See instructions for Form 502H.) Attach certification. . . . . . . . . . . .

3

3.

Claim of Right. (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Total (Add lines 1, 2 and 3.) Enter this amount on line 43 of Form 502, line 46 of Form 505, or line 53 of Form 515.

1

1 2

2