Form St - Sales, Use, And Gross Receipts Tax Return Instructions

ADVERTISEMENT

Form ST - Sales, Use, and Gross Receipts Tax Return

instructions

General and specifi c line instructions for Form ST

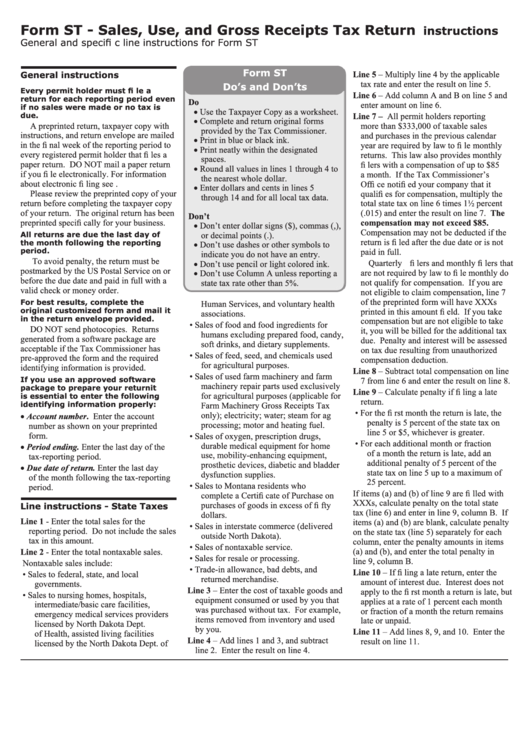

Form ST

General instructions

Line 5 – Multiply line 4 by the applicable

tax rate and enter the result on line 5.

Do’s and Don’ts

Every permit holder must fi le a

Line 6 – Add column A and B on line 5 and

return for each reporting period even

Do

enter amount on line 6.

if no sales were made or no tax is

• Use the Taxpayer Copy as a worksheet.

due.

Line 7 – All permit holders reporting

• Complete and return original forms

A preprinted return, taxpayer copy with

more than $333,000 of taxable sales

provided by the Tax Commissioner.

instructions, and return envelope are mailed

and purchases in the previous calendar

• Print in blue or black ink.

in the fi nal week of the reporting period to

year are required by law to fi le monthly

• Print neatly within the designated

every registered permit holder that fi les a

returns. This law also provides monthly

spaces.

paper return. DO NOT mail a paper return

fi lers with a compensation of up to $85

• Round all values in lines 1 through 4 to

if you fi le electronically. For information

a month. If the Tax Commissioner’s

the nearest whole dollar.

about electronic fi ling see

Offi ce notifi ed your company that it

• Enter dollars and cents in lines 5

Please review the preprinted copy of your

qualifi es for compensation, multiply the

through 14 and for all local tax data.

return before completing the taxpayer copy

total state tax on line 6 times 1½ percent

of your return. The original return has been

(.015) and enter the result on line 7. The

Don’t

preprinted specifi cally for your business.

compensation may not exceed $85.

• Don’t enter dollar signs ($), commas (,),

Compensation may not be deducted if the

All returns are due the last day of

or decimal points (.).

return is fi led after the due date or is not

• Don’t use dashes or other symbols to

the month following the reporting

period.

paid in full.

indicate you do not have an entry.

To avoid penalty, the return must be

• Don’t use pencil or light colored ink.

Quarterly fi lers and monthly fi lers that

postmarked by the US Postal Service on or

• Don’t use Column A unless reporting a

are not required by law to fi le monthly do

before the due date and paid in full with a

not qualify for compensation. If you are

state tax rate other than 5%.

valid check or money order.

not eligible to claim compensation, line 7

of the preprinted form will have XXXs

For best results, complete the

Human Services, and voluntary health

original customized form and mail it

printed in this amount fi eld. If you take

associations.

in the return envelope provided.

compensation but are not eligible to take

• Sales of food and food ingredients for

DO NOT send photocopies. Returns

it, you will be billed for the additional tax

humans excluding prepared food, candy,

generated from a software package are

due. Penalty and interest will be assessed

soft drinks, and dietary supplements.

acceptable if the Tax Commissioner has

on tax due resulting from unauthorized

• Sales of feed, seed, and chemicals used

pre-approved the form and the required

compensation deduction.

for agricultural purposes.

identifying information is provided.

Line 8 – Subtract total compensation on line

• Sales of used farm machinery and farm

If you use an approved software

7 from line 6 and enter the result on line 8.

machinery repair parts used exclusively

package to prepare your return it

Line 9 – Calculate penalty if fi ling a late

for agricultural purposes (applicable for

is essential to enter the following

return.

identifying information properly:

Farm Machinery Gross Receipts Tax

• For the fi rst month the return is late, the

• Account number. Enter the account

only); electricity; water; steam for ag

penalty is 5 percent of the state tax on

processing; motor and heating fuel.

number as shown on your preprinted

line 5 or $5, whichever is greater.

form.

• Sales of oxygen, prescription drugs,

• For each additional month or fraction

• Period ending. Enter the last day of the

durable medical equipment for home

of a month the return is late, add an

use, mobility-enhancing equipment,

tax-reporting period.

additional penalty of 5 percent of the

prosthetic devices, diabetic and bladder

• Due date of return. Enter the last day

state tax on line 5 up to a maximum of

dysfunction supplies.

of the month following the tax-reporting

25 percent.

• Sales to Montana residents who

period.

If items (a) and (b) of line 9 are fi lled with

complete a Certifi cate of Purchase on

XXXs, calculate penalty on the total state

purchases of goods in excess of fi fty

Line instructions - State Taxes

tax (line 6) and enter in line 9, column B. If

dollars.

Line 1 - Enter the total sales for the

items (a) and (b) are blank, calculate penalty

• Sales in interstate commerce (delivered

reporting period. Do not include the sales

on the state tax (line 5) separately for each

outside North Dakota).

tax in this amount.

column, enter the penalty amounts in items

• Sales of nontaxable service.

Line 2 - Enter the total nontaxable sales.

(a) and (b), and enter the total penalty in

• Sales for resale or processing.

line 9, column B.

Nontaxable sales include:

• Trade-in allowance, bad debts, and

Line 10 – If fi ling a late return, enter the

• Sales to federal, state, and local

returned merchandise.

amount of interest due. Interest does not

governments.

Line 3 – Enter the cost of taxable goods and

apply to the fi rst month a return is late, but

• Sales to nursing homes, hospitals,

equipment consumed or used by you that

applies at a rate of 1 percent each month

intermediate/basic care facilities,

was purchased without tax. For example,

or fraction of a month the return remains

emergency medical services providers

items removed from inventory and used

late or unpaid.

licensed by North Dakota Dept.

by you.

Line 11 – Add lines 8, 9, and 10. Enter the

of Health, assisted living facilities

Line 4 – Add lines 1 and 3, and subtract

result on line 11.

licensed by the North Dakota Dept. of

line 2. Enter the result on line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4