Form 306 - Coalfield Employment Enhancement Tax Credit - 2003

ADVERTISEMENT

Coalfield Employment

*VA0306103000*

2003 - Form 306

VA Department of Taxation

Enhancement Tax Credit

2601152 Rev 10/03

r

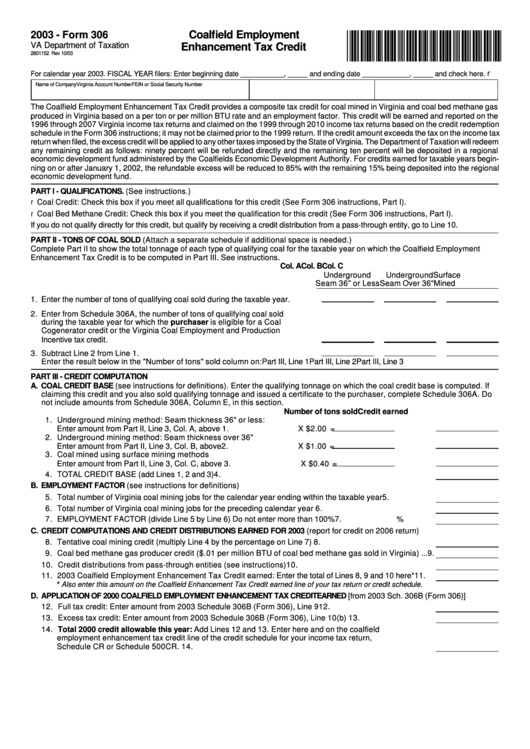

For calendar year 2003. FISCAL YEAR filers: Enter beginning date ___________, _____ and ending date ____________, _____ and check here.

Name of Company

Virginia Account Number

FEIN or Social Security Number

The Coalfield Employment Enhancement Tax Credit provides a composite tax credit for coal mined in Virginia and coal bed methane gas

produced in Virginia based on a per ton or per million BTU rate and an employment factor. This credit will be earned and reported on the

1996 through 2007 Virginia income tax returns and claimed on the 1999 through 2010 income tax returns based on the credit redemption

schedule in the Form 306 instructions; it may not be claimed prior to the 1999 return. If the credit amount exceeds the tax on the income tax

return when filed, the excess credit will be applied to any other taxes imposed by the State of Virginia. The Department of Taxation will redeem

any remaining credit as follows: ninety percent will be refunded directly and the remaining ten percent will be deposited in a regional

economic development fund administered by the Coalfields Economic Development Authority. For credits earned for taxable years begin-

ning on or after January 1, 2002, the refundable excess will be reduced to 85% with the remaining 15% being deposited into the regional

economic development fund.

PART I - QUALIFICATIONS. (See instructions.)

r Coal Credit: Check this box if you meet all qualifications for this credit (See Form 306 instructions, Part I).

r Coal Bed Methane Credit: Check this box if you meet the qualification for this credit (See Form 306 instructions, Part I).

If you do not qualify directly for this credit, but qualify by receiving a credit distribution from a pass-through entity, go to Line 10.

PART II - TONS OF COAL SOLD (Attach a separate schedule if additional space is needed.)

Complete Part II to show the total tonnage of each type of qualifying coal for the taxable year on which the Coalfield Employment

Enhancement Tax Credit is to be computed in Part III. See instructions.

Col. A

Col. B

Col. C

Underground

Underground

Surface

Seam 36" or Less Seam Over 36"

Mined

1. Enter the number of tons of qualifying coal sold during the taxable year.

2. Enter from Schedule 306A, the number of tons of qualifying coal sold

during the taxable year for which the purchaser is eligible for a Coal

Cogenerator credit or the Virginia Coal Employment and Production

Incentive tax credit.

3. Subtract Line 2 from Line 1.

Enter the result below in the "Number of tons" sold column on:

Part III, Line 1

Part III, Line 2

Part III, Line 3

PART III - CREDIT COMPUTATION

A. COAL CREDIT BASE (see instructions for definitions). Enter the qualifying tonnage on which the coal credit base is computed. If

claiming this credit and you also sold qualifying tonnage and issued a certificate to the purchaser, complete Schedule 306A. Do

not include amounts from Schedule 306A, Column E, in this section.

Number of tons sold

Credit earned

1. Underground mining method: Seam thickness 36" or less:

Enter amount from Part II, Line 3, Col. A, above .................................................. 1.

X $2.00 =

2. Underground mining method: Seam thickness over 36"

Enter amount from Part II, Line 3, Col. B, above ................................................. 2.

X $1.00 =

3. Coal mined using surface mining methods

Enter amount from Part II, Line 3, Col. C, above ................................................. 3.

X $0.40 =

4. TOTAL CREDIT BASE (add Lines 1, 2 and 3) ............................................................................................................4.

B. EMPLOYMENT FACTOR (see instructions for definitions)

5. Total number of Virginia coal mining jobs for the calendar year ending within the taxable year ......................5.

6. Total number of Virginia coal mining jobs for the preceding calendar year .........................................................6.

7. EMPLOYMENT FACTOR (divide Line 5 by Line 6) Do not enter more than 100% ..............................................7.

%

C. CREDIT COMPUTATIONS AND CREDIT DISTRIBUTIONS EARNED FOR 2003 (report for credit on 2006 return)

8. Tentative coal mining credit (multiply Line 4 by the percentage on Line 7) ..........................................................8.

9. Coal bed methane gas producer credit ($.01 per million BTU of coal bed methane gas sold in Virginia) ...9.

10. Credit distributions from pass-through entities (see instructions) ..................................................................... 10.

11. 2003 Coalfield Employment Enhancement Tax Credit earned: Enter the total of Lines 8, 9 and 10 here* ....11.

* Also enter this amount on the Coalfield Enhancement Tax Credit earned line of your tax return or credit schedule.

D. APPLICATION OF 2000 COALFIELD EMPLOYMENT ENHANCEMENT TAX CREDIT EARNED [from 2003 Sch. 306B (Form 306)]

12. Full tax credit: Enter amount from 2003 Schedule 306B (Form 306), Line 9 .................................................... 12.

13. Excess tax credit: Enter amount from 2003 Schedule 306B (Form 306), Line 10(b) ...................................... 13.

14. Total 2000 credit allowable this year: Add Lines 12 and 13. Enter here and on the coalfield

employment enhancement tax credit line of the credit schedule for your income tax return,

Schedule CR or Schedule 500CR. ........................................................................................................................... 14.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1