Instructions for Form FTB 3579

Pending Audit Tax Deposit Voucher for LPs, LLPs, and REMICs

What’s New

Enter the four-digit taxable year in the box at the top of the voucher and

complete the first line as applicable.

Round Cents to Dollars – Beginning with the 2007 tax forms, round

In the box marked “Payment due to,” fill in the circle to identify whether

cents to the nearest whole dollar. For example, round $50.50 up to $51

the payment is being made in anticipation of an additional fee or tax for

or round $25.49 down to $25.

its partners due to a federal audit, a state audit, or other reasons.

Important Information

To ensure timely and proper application of the payment to the LP’s,

AB 115 (Stats. 2005, Ch. 691), Section 45, amended California Revenue

LLP’s, or REMIC’s account, enter the federal employer identification

number (FEIN), the California Secretary of State (SOS) file number

and Taxation Code (R&TC) Section 19041.5 to repeal the “deposit in the

nature of a cash bond” provisions and replace them with conformity

(assigned upon registration with the SOS), and the amount of the

to the “cash deposit” provisions of the Internal Revenue Code (IRC)

payment in the spaces provided.

Section 6603.

Include the Private Mail Box (PMB) in the address field. Write the acronym

“PMB” first, then the box number. Example: 111 Main Street PMB 123.

Only use form FTB 3579, Pending Audit Tax Deposit Voucher for LPs,

LLPs, and REMICs, to make a tax deposit payment for previously

C When to File

filed returns if the LP, LLP, or REMIC anticipates owing an additional

Only use form FTB 3579 to make a tax deposit payment for previously

California fee or tax for its partners due to a federal audit, a state

filed returns if the LP, LLP, or REMIC anticipates owing an additional

audit, or other reasons.

California fee or tax for its partners due to a federal audit, a state audit,

Do not use this form to pay the LP, LLP, or REMIC extension amount.

or other reasons.

Instead, use form FTB 3538, Payment for Automatic Extension for LPs,

If the LP, LLP, or REMIC already received a Notice of Proposed

LLPs, and REMICs.

Assessment (NPA) or Notice of Action (NOA) and will:

General Information

• Protest or appeal the notice within the period explained in the notice

• Make a tax deposit payment to stop the running of interest

Franchise Tax Board (FTB) receives tax deposits from LPs, LLPs, and

REMICs who previously filed and expect to pay a future tax liability

Then do both of the following:

for a specific taxable year. Normally, LPs, LLPs, and REMICs make

• Send the tax deposit voucher with the payment to the address listed

tax deposits to stop the accrual of underpayment interest. FTB will

under General Information D, Where to File

consider the LP, LLP, or REMIC payment as a tax deposit only if the

• Mail your protest or appeal request to the PO Box listed on the NPA or

LP, LLP, or REMIC already filed a return for that taxable year. For

NOA

more information, go to our Website at and search for

If the LP, LLP, or REMIC is filing an amended return to report a federal

FTB Notice 2005-6.

adjustment, do not use this voucher. Attach the payment to the

A Purpose

amended return.

D Where to File

Use form FTB 3579, Pending Audit Tax Deposit Voucher for LPs, LLPs,

and REMICs to make a tax deposit payment to satisfy a future tax

Submit a separate form FTB 3579 and payment for each taxable

liability for previously filed returns. See General Information C “When

year. Make the check or money order payable to the “Franchise Tax

to File” for more information. Use this voucher with a check or money

Board.” Write the SOS file number, FEIN, and 2007 FTB 3579 on the

order payment only.

check or money order. Enclose, but do not staple, the payment and the

If there is a final balance due on the LP’s, LLP’s, or REMIC’s account,

voucher and mail to:

FTB will first apply the payment to satisfy any final balance due for the

FRANCHISE TAX BOARD

same taxable year. Any remaining amount will be held as a tax deposit.

PO BOX 942857

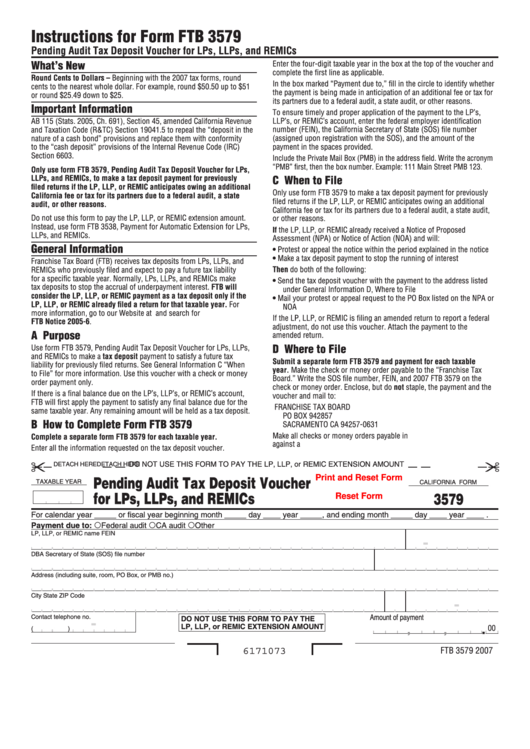

B How to Complete Form FTB 3579

SACRAMENTO CA 94257-0631

Make all checks or money orders payable in U.S. dollars and drawn

Complete a separate form FTB 3579 for each taxable year.

against a U.S. financial institution.

Enter all the information requested on the tax deposit voucher.

DO NOT USE THIS FORM TO PAY THE LP, LLP, or REMIC EXTENSION AMOUNT

DETACH HERE

DETACH HERE

Pending Audit Tax Deposit Voucher

Print and Reset Form

TAXABLE YEAR

CALIFORNIA FORM

for LPs, LLPs, and REMICs

3579

Reset Form

For calendar year _____ or fiscal year beginning month _____ day ____ year _____, and ending month _____ day ____ year ____ .

Payment due to:

Federal audit

CA audit

Other

LP, LLP, or REMIC name

FEIN

-

DBA

Secretary of State (SOS) file number

Address (including suite, room, PO Box, or PMB no.)

City

State ZIP Code

-

Amount of payment

Contact telephone no.

-

DO NOT USE THIS FORM TO PAY THE

LP, LLP, or REMIC EXTENSION AMOUNT

00

.

(

)

,

,

FTB 3579 2007

6171073

1

1