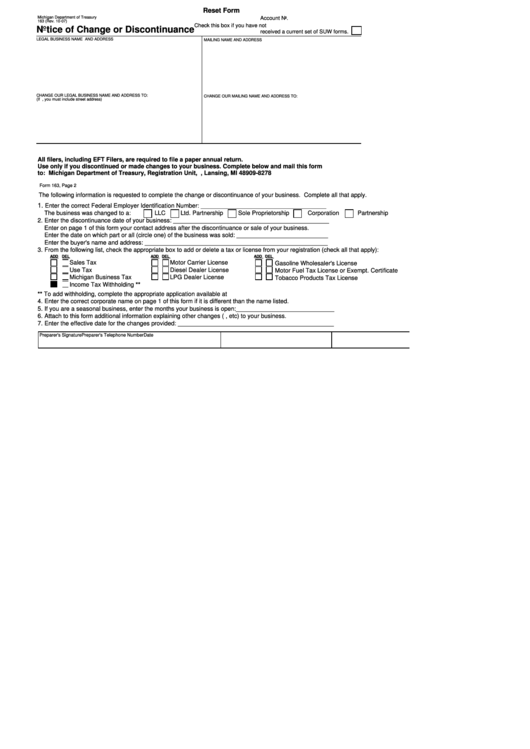

Reset Form

Michigan Department of Treasury

Account No.

163 (Rev. 10-07)

Check this box if you have not

Notice of Change or Discontinuance

received a current set of SUW forms.

LEGAL BUSINESS NAME AND ADDRESS

MAILING NAME AND ADDRESS

CHANGE OUR LEGAL BUSINESS NAME AND ADDRESS TO:

CHANGE OUR MAILING NAME AND ADDRESS TO:

(If P.O. Box No., you must include street address)

All filers, including EFT Filers, are required to file a paper annual return.

Use only if you discontinued or made changes to your business. Complete below and mail this form

to: Michigan Department of Treasury, Registration Unit, P.O. Box 30778, Lansing, MI 48909-8278

Form 163, Page 2

The following information is requested to complete the change or discontinuance of your business. Complete all that apply.

1.

Enter the correct Federal Employer Identification Number: _____________________________________

The business was changed to a:

LLC

Ltd. Partnership

Sole Proprietorship

Corporation

Partnership

2. Enter the discontinuance date of your business: ______________________________________________

Enter on page 1 of this form your contact address after the discontinuance or sale of your business.

Enter the date on which part or all (circle one) of the business was sold: ___________________________

Enter the buyer's name and address: ______________________________________________________

3. From the following list, check the appropriate box to add or delete a tax or license from your registration (check all that apply):

ADD DEL

ADD DEL

ADD DEL

Sales Tax

Motor Carrier License

Gasoline Wholesaler's License

Use Tax

Diesel Dealer License

Motor Fuel Tax License or Exempt. Certificate

Michigan Business Tax

LPG Dealer License

Tobacco Products Tax License

Income Tax Withholding **

** To add withholding, complete the appropriate application available at

4. Enter the correct corporate name on page 1 of this form if it is different than the name listed.

5. If you are a seasonal business, enter the months your business is open:_____________________________

6. Attach to this form additional information explaining other changes (i.e. mergers, etc) to your business.

7. Enter the effective date for the changes provided: ______________________________________________

Preparer's Signature

Preparer's Telephone Number

Date

1

1