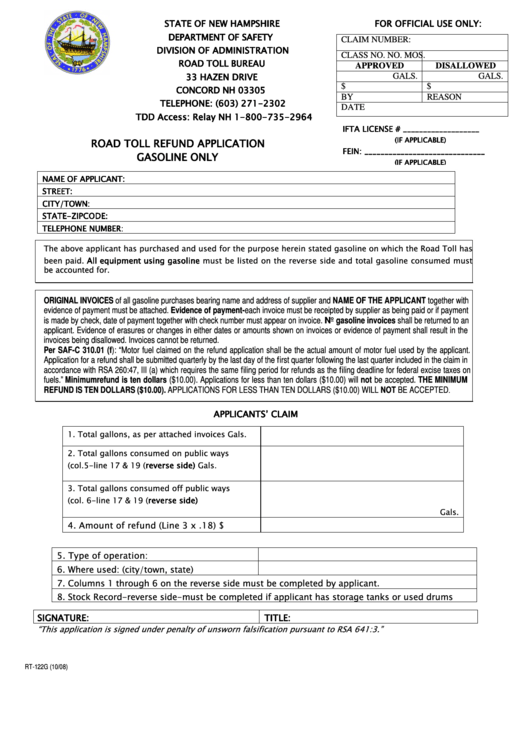

Form Rt 122g - Road Toll Refund Application Gasoline Only

ADVERTISEMENT

STATE OF NEW HAMPSHIRE

FOR OFFICIAL USE ONLY:

DEPARTMENT OF SAFETY

CLAIM NUMBER:

DIVISION OF ADMINISTRATION

CLASS NO.

NO. MOS.

ROAD TOLL BUREAU

APPROVED

DISALLOWED

33 HAZEN DRIVE

GALS.

GALS.

$

$

CONCORD NH 03305

BY

REASON NO.

TELEPHONE: (603) 271-2302

DATE

TDD Access: Relay NH 1-800-735-2964

IFTA LICENSE # ___________________

(IF APPLICABLE)

ROAD TOLL REFUND APPLICATION

FEIN: ______________________________

GASOLINE ONLY

(IF APPLICABLE)

NAME OF APPLICANT:

STREET:

CITY/TOWN:

STATE-ZIPCODE:

TELEPHONE NUMBER:

The above applicant has purchased and used for the purpose herein stated gasoline on which the Road Toll has

been paid. All equipment using gasoline must be listed on the reverse side and total gasoline consumed must

be accounted for.

ORIGINAL INVOICES of all gasoline purchases bearing name and address of supplier and NAME OF THE APPLICANT together with

evidence of payment must be attached. Evidence of payment-each invoice must be receipted by supplier as being paid or if payment

is made by check, date of payment together with check number must appear on invoice. No gasoline invoices shall be returned to an

applicant. Evidence of erasures or changes in either dates or amounts shown on invoices or evidence of payment shall result in the

invoices being disallowed. Invoices cannot be returned.

Per SAF-C 310.01 (f): “Motor fuel claimed on the refund application shall be the actual amount of motor fuel used by the applicant.

Application for a refund shall be submitted quarterly by the last day of the first quarter following the last quarter included in the claim in

accordance with RSA 260:47, III (a) which requires the same filing period for refunds as the filing deadline for federal excise taxes on

fuels.” Minimum refund is ten dollars ($10.00). Applications for less than ten dollars ($10.00) will not be accepted. THE MINIMUM

REFUND IS TEN DOLLARS ($10.00). APPLICATIONS FOR LESS THAN TEN DOLLARS ($10.00) WILL NOT BE ACCEPTED

.

APPLICANTS’ CLAIM

1. Total gallons, as per attached invoices

Gals.

2. Total gallons consumed on public ways

(col.5-line 17 & 19 (reverse side)

Gals.

3. Total gallons consumed off public ways

(col. 6-line 17 & 19 (reverse side)

Gals.

4. Amount of refund (Line 3 x .18)

$

5. Type of operation:

6. Where used: (city/town, state)

7. Columns 1 through 6 on the reverse side must be completed by applicant.

8. Stock Record-reverse side-must be completed if applicant has storage tanks or used drums

SIGNATURE:

TITLE:

“This application is signed under penalty of unsworn falsification pursuant to RSA 641:3.”

RT-122G (10/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2