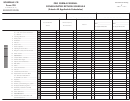

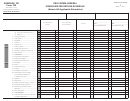

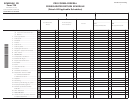

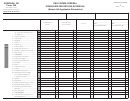

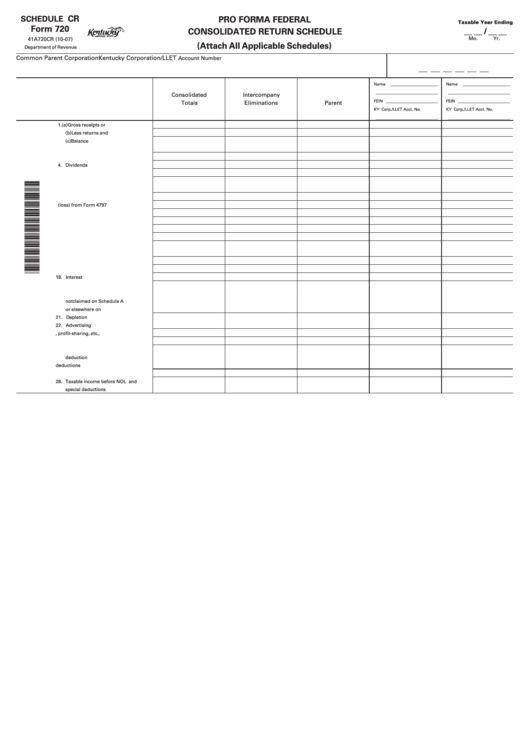

Form 720 - Schedule Cr - Pro Forma Federal Consolidated Return Schedule

ADVERTISEMENT

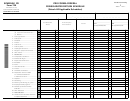

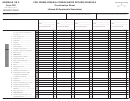

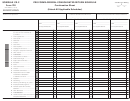

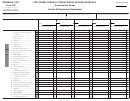

CR

SCHEDULE

PRO FORMA FEDERAL

Taxable Year Ending

Form 720

__ __ / __ __

CONSOLIDATED RETURN SCHEDULE

Mo.

Yr.

41A720CR (10-07)

(Attach All Applicable Schedules)

Department of Revenue

Common Parent Corporation

Kentucky Corporation/LLET

Account Number

___ ___ ___ ___ ___ ___

Name

_______________________

Name

_______________________

______________________________

______________________________

Consolidated

Intercompany

FEIN _________________________

FEIN _________________________

Totals

Eliminations

Parent

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

______________________________

______________________________

1. (a) Gross receipts or sales ................

(b) Less returns and allowances .......

(c) Balance .........................................

2. Cost of goods sold ...............................

3. Gross profit ..........................................

4. Dividends .............................................

5. Interest ..................................................

6. Gross rents ...........................................

7 . Gross royalties .....................................

8. Capital gain net income .......................

9. Net gain or (loss) from Form 4797 ......

10. Other income .......................................

11. Total income .........................................

12. Compensation of officers ....................

13. Salaries and wages ..............................

14. Repairs and maintenance ....................

15. Bad debts ..............................................

16. Rents .....................................................

17. Taxes and licenses ...............................

18. Interest ..................................................

19. Charitable contributions ......................

20. Depreciation from Form 4562

not claimed on Schedule A

or elsewhere on return ........................

21. Depletion ..............................................

22. Advertising ...........................................

23. Pension, profit-sharing, etc., plans .....

24. Employee benefit programs ................

25. Domestic production activities

deduction ..............................................

26. Other deductions .................................

27. Total deductions ...................................

28. Taxable income before NOL and

special deductions .................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2