Clear Form

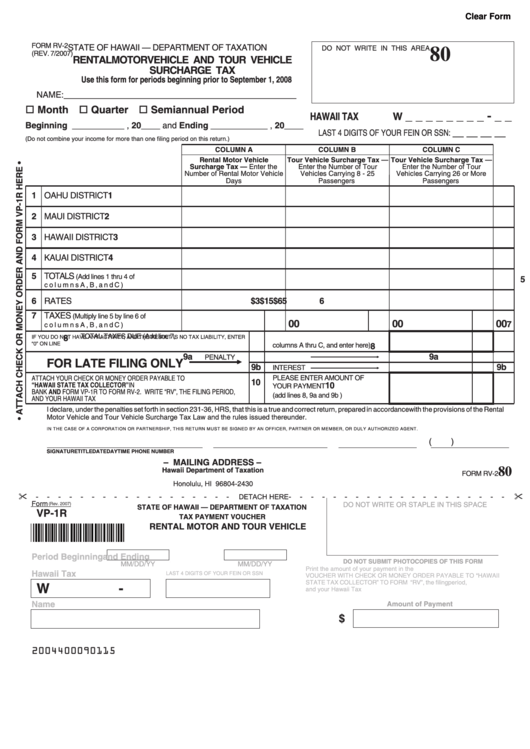

FORM RV-2

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE IN THIS AREA

80

(REV. 7/2007)

RENTAL MOTOR VEHICLE AND TOUR VEHICLE

SURCHARGE TAX

Use this form for periods beginning prior to September 1, 2008

NAME:_________________________________________________

o Month o Quarter o Semiannual Period

_ _ _ _ _ _ _ _ - _ _

HAWAII TAX I.D. NO. W

Beginning ___________ , 20____ and Ending ____________ , 20____

__ __ __ __

LAST 4 DIGITS OF YOUR FEIN OR SSN:

(Do not combine your income for more than one filing period on this return.)

COLUMN A

COLUMN B

COLUMN C

Rental Motor Vehicle

Tour Vehicle Surcharge Tax —

Tour Vehicle Surcharge Tax —

Surcharge Tax — Enter the

Enter the Number of Tour

Enter the Number of Tour

Number of Rental Motor Vehicle

Vehicles Carrying 8 - 25

Vehicles Carrying 26 or More

Days

Passengers

Passengers

1 OAHU DISTRICT

1

2 MAUI DISTRICT

2

3 HAWAII DISTRICT

3

4 KAUAI DISTRICT

4

5 TOTALS

(Add lines 1 thru 4 of

5

columns A, B, and C)

6 RATES

$3

$15

$65

6

7 TAXES

(Multiply line 5 by line 6 of

00

00

00

7

columns A, B, and C)

TOTAL TAXES DUE (Add line 7,

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER

8

“0” ON LINE 8. THIS RETURN MUST BE FILED.

columns A thru C, and enter here)

8

9a

9a

PENALTY

FOR LATE FILING ONLY

9b

9b

INTEREST

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO

PLEASE ENTER AMOUNT OF

10

“HAWAII STATE TAX COLLECTOR” IN U.S. DOLLARS DRAWN ON ANY U.S.

10

YOUR PAYMENT

BANK AND FORM VP-1R TO FORM RV-2. WRITE “RV”, THE FILING PERIOD,

(add lines 8, 9a and 9b )

AND YOUR HAWAII TAX I.D. NO. ON YOUR CHECK OR MONEY ORDER.

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the provisions of the Rental

Motor Vehicle and Tour Vehicle Surcharge Tax Law and the rules issued thereunder.

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

(

)

SIGNATURE

TITLE

DATE

DAYTIME PHONE NUMBER

– MAILING ADDRESS –

80

Hawaii Department of Taxation

FORM RV-2

P.O. Box 2430

Honolulu, HI 96804-2430

"

"

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

DETACH HERE

Form

(Rev. 2007)

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

VP-1R

TAX PAYMENT VOUCHER

RENTAL MOTOR AND TOUR VEHICLE

Period Beginning

and Ending

DO NOT SUBMIT PHOTOCOPIES OF THIS FORM

MM/DD/YY

MM/DD/YY

Print the amount of your payment in the space provided. ATTACH THIS

Hawaii Tax I.D. No.

LAST 4 DIGITS OF YOUR FEIN OR SSN

VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO “HAWAII

STATE TAX COLLECTOR” TO FORM RV-2. Write “RV”, the filing period,

W

-

and your Hawaii Tax I.D. No. on your check or money order.

Name

Amount of Payment

$

2004400090115

1

1