Clear Form

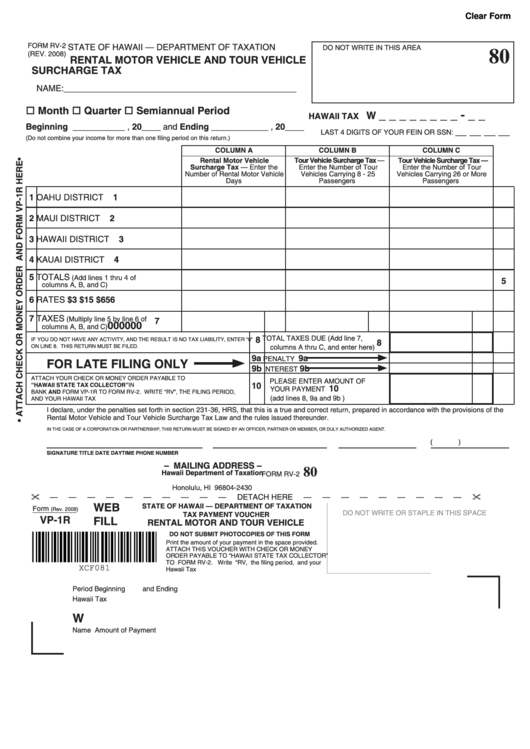

FORM RV-2

STATE OF HAWAII — DEPARTMENT OF TAXATION

80

DO NOT WRITE IN THIS AREA

(REV. 2008)

RENTAL MOTOR VEHICLE AND TOUR VEHICLE

SURCHARGE TAX

NAME:_________________________________________________

Month Quarter Semiannual Period

_ _ _ _ _ _ _ _ - _ _

HAWAII TAX I.D. NO. W

Beginning ___________ , 20____ and Ending ____________ , 20____

LAST 4 DIGITS OF YOUR FEIN OR SSN:

__ __ __ __

(Do not combine your income for more than one filing period on this return.)

COLUMN A

COLUMN B

COLUMN C

Rental Motor Vehicle

Tour Vehicle Surcharge Tax —

Tour Vehicle Surcharge Tax —

Surcharge Tax — Enter the

Enter the Number of Tour

Enter the Number of Tour

Number of Rental Motor Vehicle

Vehicles Carrying 8 - 25

Vehicles Carrying 26 or More

Days

Passengers

Passengers

1 OAHU DISTRICT

1

2 MAUI DISTRICT

2

3 HAWAII DISTRICT

3

4 KAUAI DISTRICT

4

5 TOTALS

(Add lines 1 thru 4 of

5

columns A, B, and C)

6 RATES

$3

$15

$65

6

7 TAXES

7

(Multiply line 5 by line 6 of

00

00

00

columns A, B, and C)

8

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER “0”

TOTAL TAXES DUE (Add line 7,

8

ON LINE 8. THIS RETURN MUST BE FILED.

columns A thru C, and enter here)

9a

9a

FOR LATE FILING ONLY

PENALTY

9b

9b

INTEREST

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO

PLEASE ENTER AMOUNT OF

“HAWAII STATE TAX COLLECTOR” IN U.S. DOLLARS DRAWN ON ANY U.S.

10

10

YOUR PAYMENT

BANK AND FORM VP-1R TO FORM RV-2. WRITE “RV”, THE FILING PERIOD,

AND YOUR HAWAII TAX I.D. NO. ON YOUR CHECK OR MONEY ORDER.

(add lines 8, 9a and 9b )

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the provisions of the

Rental Motor Vehicle and Tour Vehicle Surcharge Tax Law and the rules issued thereunder.

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

(

)

SIGNATURE

TITLE

DATE

DAYTIME PHONE NUMBER

– MAILING ADDRESS –

80

Hawaii Department of Taxation

FORM RV-2

P.O. Box 2430

Honolulu, HI 96804-2430

—

—

—

—

—

—

—

—

—

—

DETACH HERE

—

—

—

—

—

—

—

—

—

WEB

STATE OF HAWAII — DEPARTMENT OF TAXATION

Form

(Rev. 2008)

TAX PAYMENT VOUCHER

DO NOT WRITE OR STAPLE IN THIS SPACE

FILL

VP-1R

RENTAL MOTOR AND TOUR VEHICLE

DO NOT SUBMIT PHOTOCOPIES OF THIS FORM

Print the amount of your payment in the space provided.

ATTACH THIS VOUCHER WITH CHECK OR MONEY

ORDER PAYABLE TO “HAWAII STATE TAX COLLECTOR”

TO FORM RV-2. Write “RV, the filing period, and your

XCF081

Hawaii Tax I.D. Number on your check or money order.

Period Beginning

and Ending

Hawaii Tax I.D. Number

Last 4 Digits of Your FEIN or SSN

W

Name

Amount of Payment

1

1