Instructions For Form Wv/mft-508 - West Virginia Motor Fuel Importer Report

ADVERTISEMENT

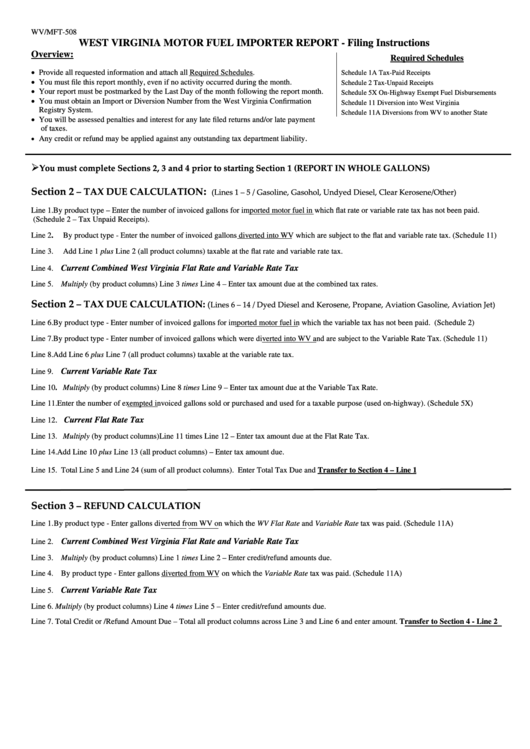

WV/MFT-508

WEST VIRGINIA MOTOR FUEL IMPORTER REPORT - Filing Instructions

Overview:

Required Schedules

• Provide all requested information and attach all Required Schedules.

Schedule 1A

Tax-Paid Receipts

• You must file this report monthly, even if no activity occurred during the month.

Schedule 2

Tax-Unpaid Receipts

• Your report must be postmarked by the Last Day of the month following the report month.

Schedule 5X

On-Highway Exempt Fuel Disbursements

• You must obtain an Import or Diversion Number from the West Virginia Confirmation

Schedule 11

Diversion into West Virginia

Registry System.

Schedule 11A

Diversions from WV to another State

• You will be assessed penalties and interest for any late filed returns and/or late payment

of taxes.

•

.

Any credit or refund may be applied against any outstanding tax department liability

You must complete Sections 2, 3 and 4 prior to starting Section 1 (REPORT IN WHOLE GALLONS)

Section 2

– TAX DUE CALCULATION

:

(Lines 1 – 5 / Gasoline, Gasohol, Undyed Diesel, Clear Kerosene/Other)

Line 1.

By product type – Enter the number of invoiced gallons for imported motor fuel in which flat rate or variable rate tax has not been paid.

(Schedule 2 – Tax Unpaid Receipts).

Line 2.

By product type - Enter the number of invoiced gallons diverted into WV which are subject to the flat and variable rate tax. (Schedule 11)

Line 3.

Add Line 1 plus Line 2 (all product columns) taxable at the flat rate and variable rate tax.

Current Combined West Virginia Flat Rate and Variable Rate Tax

Line 4.

Line 5. Multiply (by product columns) Line 3 times Line 4 – Enter tax amount due at the combined tax rates.

Section 2

– TAX DUE CALCULATION:

(

Lines 6 – 14 / Dyed Diesel and Kerosene, Propane, Aviation Gasoline, Aviation Jet)

Line 6. By product type - Enter number of invoiced gallons for imported motor fuel in which the variable tax has not been paid. (Schedule 2)

Line 7. By product type - Enter number of invoiced gallons which were diverted into WV and are subject to the Variable Rate Tax. (Schedule 11)

Line 8. Add Line 6 plus Line 7 (all product columns) taxable at the variable rate tax.

Current Variable Rate Tax

Line 9.

Line 10

Multiply (by product columns) Line 8 times Line 9 – Enter tax amount due at the Variable Tax Rate.

.

Line 11. Enter the number of exempted invoiced gallons sold or purchased and used for a taxable purpose (used on-highway). (Schedule 5X)

. Current Flat Rate Tax

Line 12

Line 13. Multiply (by product columns) Line 11 times Line 12 – Enter tax amount due at the Flat Rate Tax.

Line 14. Add Line 10 plus Line 13 (all product columns) – Enter tax amount due.

Line 15. Total Line 5 and Line 24 (sum of all product columns). Enter Total Tax Due and Transfer to Section 4 – Line 1

Section 3

– REFUND CALCULATION

Line 1. By product type - Enter gallons diverted from WV on which the WV Flat Rate and Variable Rate tax was paid. (Schedule 11A)

Current Combined West Virginia Flat Rate and Variable Rate Tax

Line 2.

Line 3. Multiply (by product columns) Line 1 times Line 2 – Enter credit/refund amounts due.

Line 4. By product type - Enter gallons diverted from WV on which the Variable Rate tax was paid. (Schedule 11A)

Current Variable Rate Tax

Line 5.

Line 6.

Multiply (by product columns) Line 4 times Line 5 – Enter credit/refund amounts due.

Line 7.

Total Credit or /Refund Amount Due – Total all product columns across Line 3 and Line 6 and enter amount. Transfer to Section 4 - Line 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2