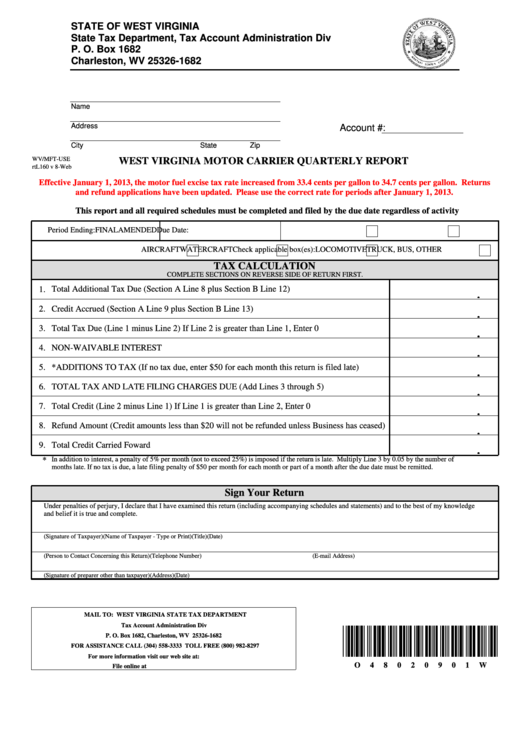

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P. O. Box 1682

Charleston, WV 25326-1682

Name

Address

Account #:

City

State

Zip

WV/MFT-USE

WEST VIRGINIA MOTOR CARRIER QUARTERLY REPORT

rtL160 v 8-Web

Effective January 1, 2013, the motor fuel excise tax rate increased from 33.4 cents per gallon to 34.7 cents per gallon. Returns

and refund applications have been updated. Please use the correct rate for periods after January 1, 2013.

This report and all required schedules must be completed and filed by the due date regardless of activity

Period Ending:

Due Date:

FINAL

AMENDED

Check applicable box(es):

AIRCRAFT

WATERCRAFT

LOCOMOTIVE

TRUCK, BUS, OTHER

TAX CALCULATION

COMPLETE SECTIONS ON REVERSE SIDE OF RETURN FIRST.

Total Additional Tax Due (Section A Line 8 plus Section B Line 12)

1.

.

2.

Credit Accrued (Section A Line 9 plus Section B Line 13)

.

3.

Total Tax Due (Line 1 minus Line 2) If Line 2 is greater than Line 1, Enter 0

.

4.

NON-WAIVABLE INTEREST

.

5.

*ADDITIONS TO TAX (If no tax due, enter $50 for each month this return is filed late)

.

6.

TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 3 through 5)

.

7.

Total Credit (Line 2 minus Line 1) If Line 1 is greater than Line 2, Enter 0

.

8.

Refund Amount (Credit amounts less than $20 will not be refunded unless Business has ceased)

.

9.

Total Credit Carried Foward

.

In addition to interest, a penalty of 5% per month (not to exceed 25%) is imposed if the return is late. Multiply Line 3 by 0.05 by the number of

*

months late. If no tax is due, a late filing penalty of $50 per month for each month or part of a month after the due date must be remitted.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge

and belief it is true and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(E-mail Address)

(Signature of preparer other than taxpayer)

(Address)

(Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P. O. Box 1682, Charleston, WV 25326-1682

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

O

4

8

0

2

0

9

0

1

W

File online at https://mytaxes.wvtax.gov

1

1 2

2