Form Pv50 - Preparer'S Paper-Filing Fee Payment

ADVERTISEMENT

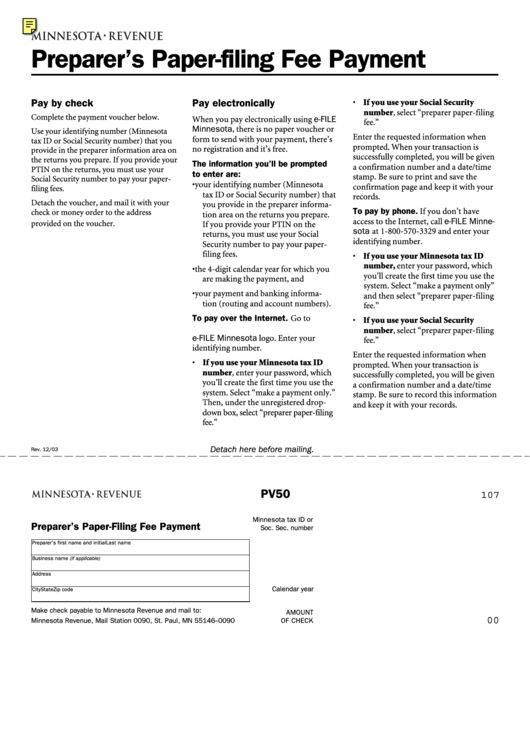

Preparer’s Paper-filing Fee Payment

• If you use your Social Security

Pay by check

Pay electronically

number, select “preparer paper-filing

Complete the payment voucher below.

When you pay electronically using e-FILE

fee.”

Minnesota, there is no paper voucher or

Use your identifying number (Minnesota

Enter the requested information when

form to send with your payment, there’s

tax ID or Social Security number) that you

prompted. When your transaction is

no registration and it’s free.

provide in the preparer information area on

successfully completed, you will be given

the returns you prepare. If you provide your

The information you’ll be prompted

a confirmation number and a date/time

PTIN on the returns, you must use your

to enter are:

stamp. Be sure to print and save the

Social Security number to pay your paper-

• your identifying number (Minnesota

confirmation page and keep it with your

filing fees.

tax ID or Social Security number) that

records.

Detach the voucher, and mail it with your

you provide in the preparer informa-

To pay by phone. If you don’t have

check or money order to the address

tion area on the returns you prepare.

access to the Internet, call e-FILE Minne-

provided on the voucher.

If you provide your PTIN on the

sota at 1-800-570-3329 and enter your

returns, you must use your Social

identifying number.

Security number to pay your paper-

filing fees.

• If you use your Minnesota tax ID

number, enter your password, which

• the 4-digit calendar year for which you

you’ll create the first time you use the

are making the payment, and

system. Select “make a payment only”

• your payment and banking informa-

and then select “preparer paper-filing

tion (routing and account numbers).

fee.”

To pay over the Internet. Go to

• If you use your Social Security

and click on the

number, select “preparer paper-filing

e-FILE Minnesota logo. Enter your

fee.”

identifying number.

Enter the requested information when

• If you use your Minnesota tax ID

prompted. When your transaction is

number, enter your password, which

successfully completed, you will be given

you’ll create the first time you use the

a confirmation number and a date/time

system. Select “make a payment only.”

stamp. Be sure to record this information

Then, under the unregistered drop-

and keep it with your records.

down box, select “preparer paper-filing

fee.”

Detach here before mailing.

Rev. 12/03

2003

PV50

107

Minnesota tax ID or

Preparer’s Paper-Filing Fee Payment

Soc. Sec. number

Preparer’s first name and initial

Last name

Business name (if applicable)

Address

Calendar year

City

State

Zip code

Make check payable to Minnesota Revenue and mail to:

AMOUNT

00

Minnesota Revenue, Mail Station 0090, St. Paul, MN 55146--0090

OF CHECK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1