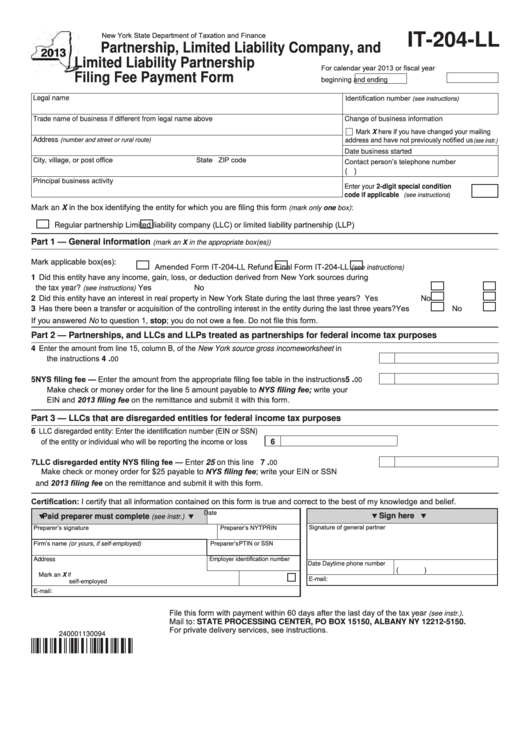

New York State Department of Taxation and Finance

IT-204-LL

Partnership, Limited Liability Company, and

Limited Liability Partnership

For calendar year 2013 or fiscal year

Filing Fee Payment Form

beginning

and ending

Identification number

Legal name

(see instructions)

Trade name of business if different from legal name above

Change of business information

Mark X here if you have changed your mailing

address and have not previously notified us

Address

(number and street or rural route)

(see instr.)

Date business started

City, village, or post office State

ZIP code

Contact person’s telephone number

(

)

Principal business activity

Enter your 2-digit special condition

code if applicable

.......

(see instructions)

Mark an X in the box identifying the entity for which you are filing this form

(mark only one box):

Regular partnership

Limited liability company (LLC) or limited liability partnership (LLP)

Part 1 — General information

(mark an X in the appropriate box(es))

Mark applicable box(es):

Amended Form IT-204-LL

Refund

Final Form IT-204-LL

(see instructions)

1 Did this entity have any income, gain, loss, or deduction derived from New York sources during

....................................................................................................................... Yes

No

the tax year?

(see instructions)

2 Did this entity have an interest in real property in New York State during the last three years? ...................... Yes

No

3 Has there been a transfer or acquisition of the controlling interest in the entity during the last three years? ..... Yes

No

If you answered No to question 1, stop; you do not owe a fee. Do not file this form.

Part 2 — Partnerships, and LLCs and LLPs treated as partnerships for federal income tax purposes

4 Enter the amount from line 15, column B, of the New York source gross income worksheet in

the instructions ..............................................................................................................................

.

4

00

5 NYS filing fee — Enter the amount from the appropriate filing fee table in the instructions .............

.

5

00

Make check or money order for the line 5 amount payable to NYS filing fee; write your

EIN and 2013 filing fee on the remittance and submit it with this form.

Part 3 — LLCs that are disregarded entities for federal income tax purposes

6 LLC disregarded entity: Enter the identification number (EIN or SSN)

of the entity or individual who will be reporting the income or loss ....

6

7 LLC disregarded entity NYS filing fee — Enter 25 on this line .....................................................

.

7

00

Make check or money order for $25 payable to NYS filing fee; write your EIN or SSN

and 2013 filing fee on the remittance and submit it with this form.

Certification: I certify that all information contained on this form is true and correct to the best of my knowledge and belief.

Date

Sign here

Paid preparer must complete

(see instr.)

Signature of general partner

Preparer’s signature

Preparer’s NYTPRIN

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

Employer identification number

Address

Date

Daytime phone number

(

)

Mark an X if

E-mail:

self-employed

E-mail:

File this form with payment within 60 days after the last day of the tax year

.

(see instr.)

Mail to: STATE PROCESSING CENTER, PO BOX 15150, ALBANY NY 12212-5150.

For private delivery services, see instructions.

240001130094

1

1