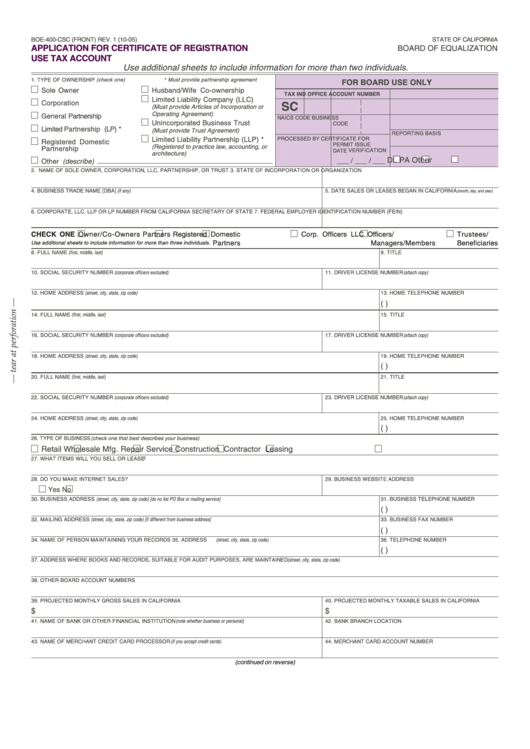

BOE-400-CSC (FRONT) REV. 1 (10-05)

STATE OF CALIFORNIA

APPLICATION FOR CERTIFICATE OF REGISTRATION

BOARD OF EQUALIZATION

USE TAX ACCOUNT

Use additional sheets to include information for more than two individuals.

1. TYPE OF OWNERSHIP (check one)

* Must provide partnership agreement

FOR BOARD USE ONLY

Sole Owner

Husband/Wife Co-ownership

TAX

IND

OFFICE

ACCOUNT NUMBER

Limited Liability Company (LLC)

Corporation

SC

(Must provide Articles of Incorporation or

Operating Agreement)

General Partnership

NAICS CODE

BUSINESS

A.C.C.

AREA CODE

Unincorporated Business Trust

CODE

Limited Partnership (LP) *

(Must provide Trust Agreement)

REPORTING BASIS

PROCESSED BY

CERTIFICATE FOR

Limited Liability Partnership (LLP) *

Registered Domestic

PERMIT ISSUE

(Registered to practice law, accounting, or

Partnership

VERIFICATION

DATE

architecture)

DL

PA

Other

Other (describe)

___ / ___ / ___

2. NAME OF SOLE OWNER, CORPORATION, LLC, PARTNERSHIP, OR TRUST

3. STATE OF INCORPORATION OR ORGANIZATION

4. BUSINESS TRADE NAME [DBA] (if any)

5. DATE SALES OR LEASES BEGAN IN CALIFORNIA

(month, day, and year)

6. CORPORATE, LLC, LLP OR LP NUMBER FROM CALIFORNIA SECRETARY OF STATE

7. FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

CHECK ONE

Owner/Co-Owners

Partners

Registered Domestic

Corp. Officers

LLC Officers/

Trustees/

Partners

Managers/Members

Beneficiaries

Use additional sheets to include information for more than three individuals.

8. FULL NAME (first, middle, last)

9. TITLE

10. SOCIAL SECURITY NUMBER (corporate officers excluded)

11. DRIVER LICENSE NUMBER (attach copy)

12. HOME ADDRESS (street, city, state, zip code)

13. HOME TELEPHONE NUMBER

(

)

14. FULL NAME (first, middle, last)

15. TITLE

16. SOCIAL SECURITY NUMBER (corporate officers excluded)

17. DRIVER LICENSE NUMBER (attach copy)

18. HOME ADDRESS (street, city, state, zip code)

19. HOME TELEPHONE NUMBER

(

)

20. FULL NAME (first, middle, last)

21. TITLE

22. SOCIAL SECURITY NUMBER (corporate officers excluded)

23. DRIVER LICENSE NUMBER (attach copy)

24. HOME ADDRESS (street, city, state, zip code)

25. HOME TELEPHONE NUMBER

(

)

26. TYPE OF BUSINESS (check one that best describes your business)

Retail

Wholesale

Mfg.

Repair

Service

Construction Contractor

Leasing

27. WHAT ITEMS WILL YOU SELL OR LEASE ?

28. DO YOU MAKE INTERNET SALES?

29. BUSINESS WEBSITE ADDRESS

www.

Yes

No

30. BUSINESS ADDRESS (street, city, state, zip code) [do no list PO Box or mailing service]

31. BUSINESS TELEPHONE NUMBER

(

)

32. MAILING ADDRESS (street, city, state, zip code) [if different from business address]

33. BUSINESS FAX NUMBER

(

)

34. NAME OF PERSON MAINTAINING YOUR RECORDS

35. ADDRESS (street, city, state, zip code)

36. TELEPHONE NUMBER

(

)

37. ADDRESS WHERE BOOKS AND RECORDS, SUITABLE FOR AUDIT PURPOSES, ARE MAINTAINED (street, city, state, zip code)

38. OTHER BOARD ACCOUNT NUMBERS

39. PROJECTED MONTHLY GROSS SALES IN CALIFORNIA

40. PROJECTED MONTHLY TAXABLE SALES IN CALIFORNIA

$

$

41. NAME OF BANK OR OTHER FINANCIAL INSTITUTION (note whether business or personal)

42. BANK BRANCH LOCATION

43. NAME OF MERCHANT CREDIT CARD PROCESSOR (if you accept credit cards)

44. MERCHANT CARD ACCOUNT NUMBER

(continued on reverse)

1

1 2

2