City Of Stow Income Tax Information And Instructions - 2006

ADVERTISEMENT

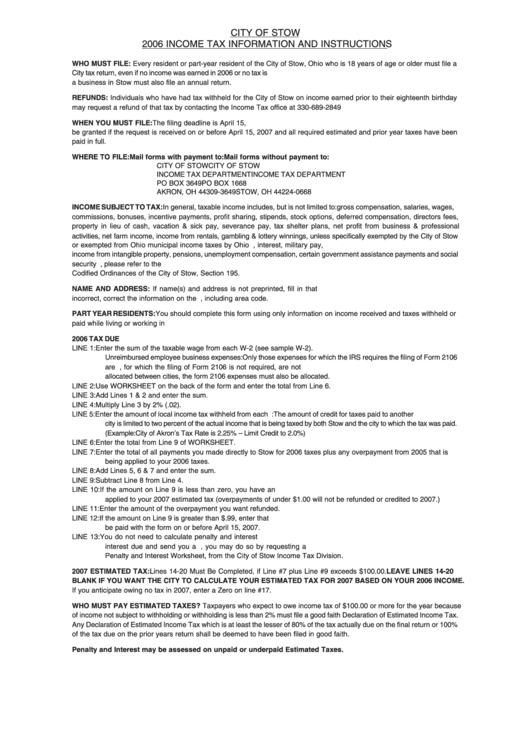

CITY OF STOW

2006 INCOME TAX INFORMATION AND INSTRUCTIONS

WHO MUST FILE: Every resident or part-year resident of the City of Stow, Ohio who is 18 years of age or older must file a

City tax return, even if no income was earned in 2006 or no tax is due. Every Non-resident who owns rental property or operates

a business in Stow must also file an annual return.

REFUNDS: Individuals who have had tax withheld for the City of Stow on income earned prior to their eighteenth birthday

may request a refund of that tax by contacting the Income Tax office at 330-689-2849

WHEN YOU MUST FILE: The filing deadline is April 15, 2007. An automatic six month extension of time to file a return will

be granted if the request is received on or before April 15, 2007 and all required estimated and prior year taxes have been

paid in full.

WHERE TO FILE:

Mail forms with payment to:

Mail forms without payment to:

CITY OF STOW

CITY OF STOW

INCOME TAX DEPARTMENT

INCOME TAX DEPARTMENT

PO BOX 3649

PO BOX 1668

AKRON, OH 44309-3649

STOW, OH 44224-0668

INCOME SUBJECT TO TAX: In general, taxable income includes, but is not limited to: gross compensation, salaries, wages,

commissions, bonuses, incentive payments, profit sharing, stipends, stock options, deferred compensation, directors fees,

property in lieu of cash, vacation & sick pay, severance pay, tax shelter plans, net profit from business & professional

activities, net farm income, income from rentals, gambling & lottery winnings, unless specifically exempted by the City of Stow

or exempted from Ohio municipal income taxes by Ohio law. Non-taxable income includes dividends, interest, military pay,

income from intangible property, pensions, unemployment compensation, certain government assistance payments and social

security benefits. This list is not all-inclusive. For a complete definition of taxable and nontaxable income, please refer to the

Codified Ordinances of the City of Stow, Section 195.

NAME AND ADDRESS: If name(s) and address is not preprinted, fill in that information. If the information preprinted is

incorrect, correct the information on the form. Please provide a daytime phone number, including area code.

PART YEAR RESIDENTS: You should complete this form using only information on income received and taxes withheld or

paid while living or working in Stow. You must also provide the date you moved into or out of Stow.

2006 TAX DUE

LINE 1:

Enter the sum of the taxable wage from each W-2 (see sample W-2).

Unreimbursed employee business expenses: Only those expenses for which the IRS requires the filing of Form 2106

are deductible. Expenses, for which the filing of Form 2106 is not required, are not deductible. If wage income is

allocated between cities, the form 2106 expenses must also be allocated.

LINE 2:

Use WORKSHEET on the back of the form and enter the total from Line 6.

LINE 3:

Add Lines 1 & 2 and enter the sum.

LINE 4:

Multiply Line 3 by 2% (.02).

LINE 5:

Enter the amount of local income tax withheld from each W-2. NOTE: The amount of credit for taxes paid to another

city is limited to two percent of the actual income that is being taxed by both Stow and the city to which the tax was paid.

(Example: City of Akron’s Tax Rate is 2.25% – Limit Credit to 2.0%)

LINE 6:

Enter the total from Line 9 of WORKSHEET.

LINE 7:

Enter the total of all payments you made directly to Stow for 2006 taxes plus any overpayment from 2005 that is

being applied to your 2006 taxes.

LINE 8:

Add Lines 5, 6 & 7 and enter the sum.

LINE 9:

Subtract Line 8 from Line 4.

LINE 10: If the amount on Line 9 is less than zero, you have an overpayment. Enter the overpayment amount you want

applied to your 2007 estimated tax (overpayments of under $1.00 will not be refunded or credited to 2007.)

LINE 11: Enter the amount of the overpayment you want refunded.

LINE 12: If the amount on Line 9 is greater than $.99, enter that amount. This is your 2006 balance due. This amount must

be paid with the form on or before April 15, 2007.

LINE 13: You do not need to calculate penalty and interest charges. The City of Stow will calculate any penalties and/or

interest due and send you a bill. If you wish to calculate the amount yourself, you may do so by requesting a

Penalty and Interest Worksheet, from the City of Stow Income Tax Division.

2007 ESTIMATED TAX: Lines 14-20 Must Be Completed, if Line #7 plus Line #9 exceeds $100.00. LEAVE LINES 14-20

BLANK IF YOU WANT THE CITY TO CALCULATE YOUR ESTIMATED TAX FOR 2007 BASED ON YOUR 2006 INCOME.

If you anticipate owing no tax in 2007, enter a Zero on line #17.

WHO MUST PAY ESTIMATED TAXES? Taxpayers who expect to owe income tax of $100.00 or more for the year because

of income not subject to withholding or withholding is less than 2% must file a good faith Declaration of Estimated Income Tax.

Any Declaration of Estimated Income Tax which is at least the lesser of 80% of the tax actually due on the final return or 100%

of the tax due on the prior years return shall be deemed to have been filed in good faith.

Penalty and Interest may be assessed on unpaid or underpaid Estimated Taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2