Keep this worksheet for your records.

Offer in Compromise (OIC)

Do not send to IRS.

Application Fee Worksheet

If your OIC is based solely on Doubt as to Liability, do not submit the fee.

If you answered YES to any of the questions on page 2, then do not proceed any further. You are not eligible

to have your offer considered at this time.

If you answered NO to all of the questions on page 2, then you may be eligible to have your offer considered and

you may proceed completing the worksheet. However, it is important that you use the current version Form 656,

Offer in Compromise , and Forms 433-A, Collection Information Statement for Wage Earners and Self-Employed

Individuals , and/or 433-B, Collection Information Statement for Businesses that are included in this package.

The application fee does not apply to individuals whose income falls at or below levels based on poverty guidelines established

by the U.S. Department of Health and Human Services (HHS) under authority of section 673(2) of the Omnibus Reconciliation

Act of 1981 (95 Stat. 357, 511). The exception for taxpayers with incomes below these levels only applies to individuals; it does

not apply to other entities such as corporations or partnerships.

If you are an individual, follow the steps below to determine if you must remit the application fee along with your

Form 656, Offer in Compromise.

1.

Family Unit Size______. Enter the total number of dependents (including yourself and your spouse) listed in

Section 1 of Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals.

Total Monthly Income

. Enter the amount of your total monthly income from Section 9, Line 34

2.

Total Income_____________. Enter the amount of your total monthly income from Section 9, Line 34 of the

of the Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals.

Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals.

3.

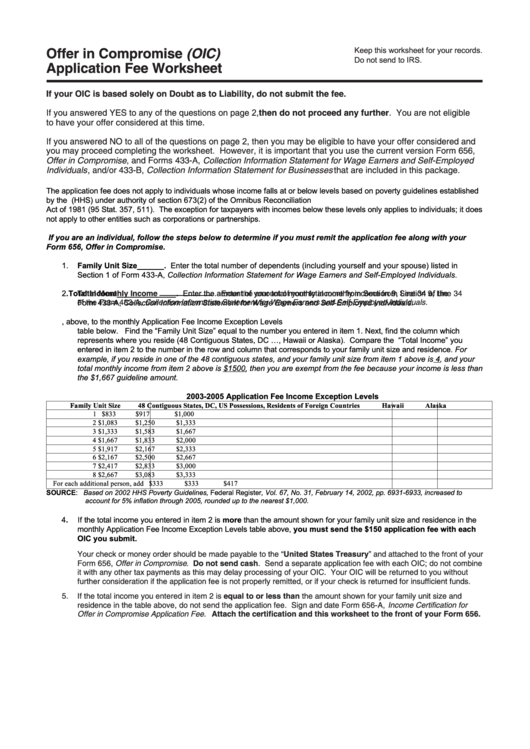

Compare the information you entered in items 1 and 2, above, to the monthly Application Fee Income Exception Levels

table below. Find the “Family Unit Size” equal to the number you entered in item 1. Next, find the column which

represents where you reside (48 Contiguous States, DC …, Hawaii or Alaska). Compare the “Total Income” you

entered in item 2 to the number in the row and column that corresponds to your family unit size and residence. For

example, if you reside in one of the 48 contiguous states, and your family unit size from item 1 above is 4, and your

total monthly income from item 2 above is $1500, then you are exempt from the fee because your income is less than

the $1,667 guideline amount.

2003-2005 Application Fee Income Exception Levels

Family Unit Size

48 Contiguous States, DC, US Possessions, Residents of Foreign Countries

Hawaii

Alaska

1

$833

$917

$1,000

2

$1,083

$1,250

$1,333

3

$1,333

$1,583

$1,667

4

$1,667

$1,833

$2,000

5

$1,917

$2,167

$2,333

6

$2,167

$2,500

$2,667

7

$2,417

$2,833

$3,000

8

$2,667

$3,083

$3,333

For each additional person, add

$333

$333

$417

SOURCE: Based on 2002 HHS Poverty Guidelines, Federal Register, Vol. 67, No. 31, February 14, 2002, pp. 6931-6933, increased to

account for 5% inflation through 2005, rounded up to the nearest $1,000.

4.

If the total income you entered in item 2 is more than the amount shown for your family unit size and residence in the

monthly Application Fee Income Exception Levels table above, you must send the $150 application fee with each

OIC you submit.

Your check or money order should be made payable to the “United States Treasury” and attached to the front of your

Form 656, Offer in Compromise . Do not send cash. Send a separate application fee with each OIC; do not combine

it with any other tax payments as this may delay processing of your OIC. Your OIC will be returned to you without

further consideration if the application fee is not properly remitted, or if your check is returned for insufficient funds.

5.

If the total income you entered in item 2 is equal to or less than the amount shown for your family unit size and

residence in the table above, do not send the application fee. Sign and date Form 656-A, Income Certification for

Offer in Compromise Application Fee. Attach the certification and this worksheet to the front of your Form 656.

1

1 2

2