Instructions For Form 1099-Patr - 2006

ADVERTISEMENT

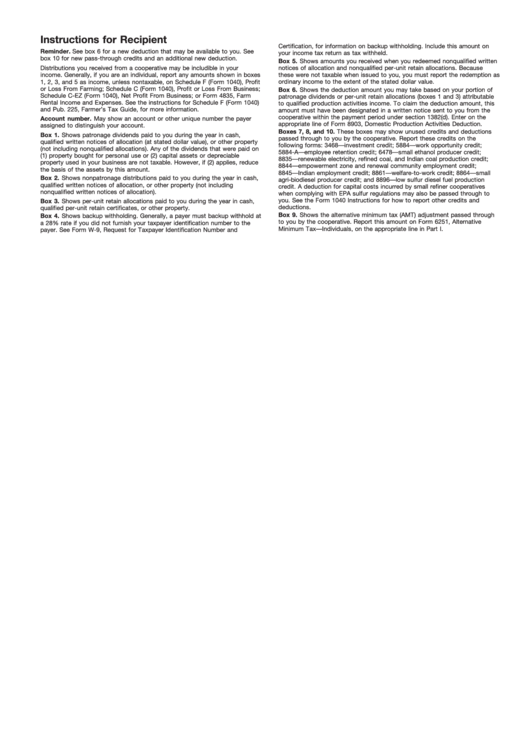

Instructions for Recipient

Certification, for information on backup withholding. Include this amount on

Reminder. See box 6 for a new deduction that may be available to you. See

your income tax return as tax withheld.

box 10 for new pass-through credits and an additional new deduction.

Box 5. Shows amounts you received when you redeemed nonqualified written

notices of allocation and nonqualified per-unit retain allocations. Because

Distributions you received from a cooperative may be includible in your

income. Generally, if you are an individual, report any amounts shown in boxes

these were not taxable when issued to you, you must report the redemption as

1, 2, 3, and 5 as income, unless nontaxable, on Schedule F (Form 1040), Profit

ordinary income to the extent of the stated dollar value.

or Loss From Farming; Schedule C (Form 1040), Profit or Loss From Business;

Box 6. Shows the deduction amount you may take based on your portion of

Schedule C-EZ (Form 1040), Net Profit From Business; or Form 4835, Farm

patronage dividends or per-unit retain allocations (boxes 1 and 3) attributable

Rental Income and Expenses. See the instructions for Schedule F (Form 1040)

to qualified production activities income. To claim the deduction amount, this

and Pub. 225, Farmer’s Tax Guide, for more information.

amount must have been designated in a written notice sent to you from the

cooperative within the payment period under section 1382(d). Enter on the

Account number. May show an account or other unique number the payer

appropriate line of Form 8903, Domestic Production Activities Deduction.

assigned to distinguish your account.

Boxes 7, 8, and 10. These boxes may show unused credits and deductions

Box 1. Shows patronage dividends paid to you during the year in cash,

passed through to you by the cooperative. Report these credits on the

qualified written notices of allocation (at stated dollar value), or other property

following forms: 3468—investment credit; 5884—work opportunity credit;

(not including nonqualified allocations). Any of the dividends that were paid on

5884-A—employee retention credit; 6478—small ethanol producer credit;

(1) property bought for personal use or (2) capital assets or depreciable

8835—renewable electricity, refined coal, and Indian coal production credit;

property used in your business are not taxable. However, if (2) applies, reduce

8844—empowerment zone and renewal community employment credit;

the basis of the assets by this amount.

8845—Indian employment credit; 8861—welfare-to-work credit; 8864—small

Box 2. Shows nonpatronage distributions paid to you during the year in cash,

agri-biodiesel producer credit; and 8896—low sulfur diesel fuel production

qualified written notices of allocation, or other property (not including

credit. A deduction for capital costs incurred by small refiner cooperatives

nonqualified written notices of allocation).

when complying with EPA sulfur regulations may also be passed through to

you. See the Form 1040 Instructions for how to report other credits and

Box 3. Shows per-unit retain allocations paid to you during the year in cash,

deductions.

qualified per-unit retain certificates, or other property.

Box 9. Shows the alternative minimum tax (AMT) adjustment passed through

Box 4. Shows backup withholding. Generally, a payer must backup withhold at

to you by the cooperative. Report this amount on Form 6251, Alternative

a 28% rate if you did not furnish your taxpayer identification number to the

Minimum Tax—Individuals, on the appropriate line in Part I.

payer. See Form W-9, Request for Taxpayer Identification Number and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25