State Form 21928 - Schedule It-40qec - Enterprise Zone Qualified Employee Deduction Certificate - 2008

ADVERTISEMENT

SCHEDULE

Indiana Department of Revenue

Privacy Notice

IT-40QEC

Enterprise Zone

2008

State Form 21928

The records in this series are

Qualified Employee Deduction

(R3 / 9-08)

CONFIDENTIAL

Certificate

according to the provisions of

I.C. 6-8.1-7-1 and I.C. 5-28-15-8

--- Attach to Indiana individual income tax return ---

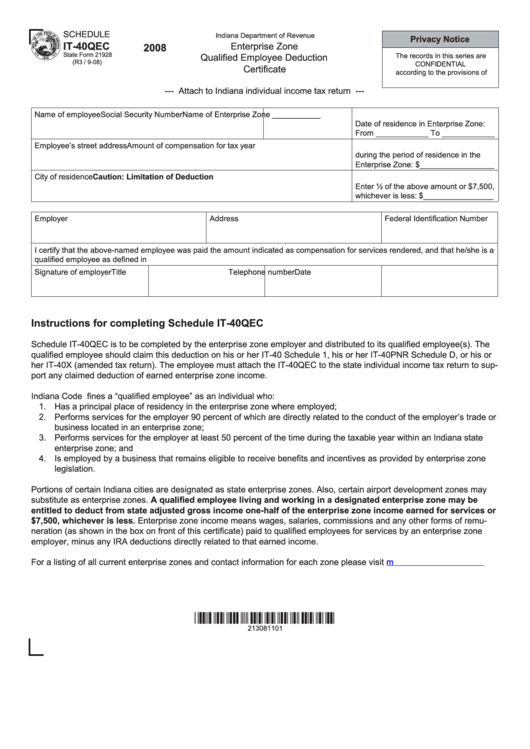

Name of employee

Social Security Number Name of Enterprise Zone ___________

Date of residence in Enterprise Zone:

From ____________ To ____________

Employee’s street address

Amount of compensation for tax year

during the period of residence in the

Enterprise Zone: $_________________

City of residence

Caution: Limitation of Deduction

Enter ½ of the above amount or $7,500,

whichever is less: $________________

Employer

Address

Federal Identification Number

I certify that the above-named employee was paid the amount indicated as compensation for services rendered, and that he/she is a

qualified employee as defined in I.C. 6-3-2-8.

Signature of employer

Title

Telephone number

Date

Instructions for completing Schedule IT-40QEC

Schedule IT-40QEC is to be completed by the enterprise zone employer and distributed to its qualified employee(s). The

qualified employee should claim this deduction on his or her IT-40 Schedule 1, his or her IT-40PNR Schedule D, or his or

her IT-40X (amended tax return). The employee must attach the IT-40QEC to the state individual income tax return to sup-

port any claimed deduction of earned enterprise zone income.

Indiana Code I.C. 6-3-2-8 defines a “qualified employee” as an individual who:

1.

Has a principal place of residency in the enterprise zone where employed;

2.

Performs services for the employer 90 percent of which are directly related to the conduct of the employer’s trade or

business located in an enterprise zone;

3.

Performs services for the employer at least 50 percent of the time during the taxable year within an Indiana state

enterprise zone; and

4.

Is employed by a business that remains eligible to receive benefits and incentives as provided by enterprise zone

legislation.

Portions of certain Indiana cities are designated as state enterprise zones. Also, certain airport development zones may

substitute as enterprise zones. A qualified employee living and working in a designated enterprise zone may be

entitled to deduct from state adjusted gross income one-half of the enterprise zone income earned for services or

$7,500, whichever is less. Enterprise zone income means wages, salaries, commissions and any other forms of remu-

neration (as shown in the box on front of this certificate) paid to qualified employees for services by an enterprise zone

employer, minus any IRA deductions directly related to that earned income.

For a listing of all current enterprise zones and contact information for each zone please visit

*213081101*

213081101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1