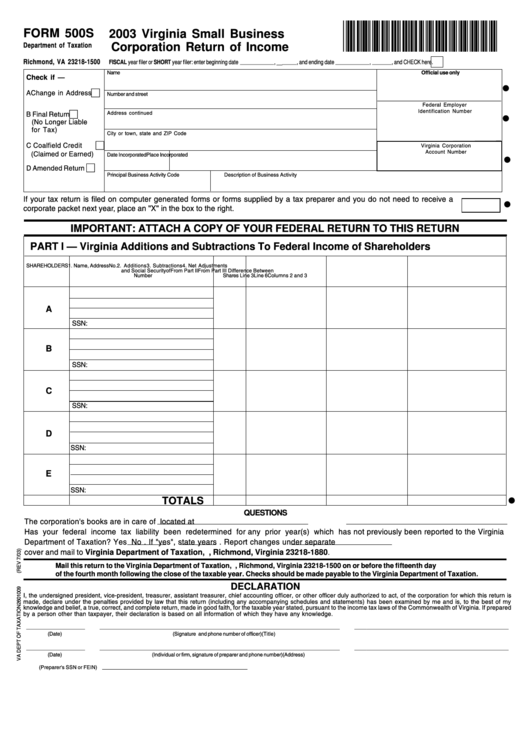

Form 500s - Virginia Small Business Corporation Return Of Income - 2003

ADVERTISEMENT

*VA500S103888*

FORM 500S

2003 Virginia Small Business

Department of Taxation

Corporation Return of Income

P.O. Box 1500

Richmond, VA 23218-1500

FISCAL year filer or SHORT year filer: enter beginning date

, __

, and ending date

,

, and CHECK here.

______________

______

______________

________

Name

Official use only

Check if —

w

A Change in Address

j

Number and street

Federal Employer

Identification Number

j

Address continued

B Final Return

w

(No Longer Liable

for Tax)

City or town, state and ZIP Code

C Coalfield Credit

j

Virginia Corporation

Account Number

(Claimed or Earned)

Date Incorporated

Place Incorporated

w

j

D Amended Return

Principal Business Activity Code

Description of Business Activity

If your tax return is filed on computer generated forms or forms supplied by a tax preparer and you do not need to receive a

w

corporate packet next year, place an "X" in the box to the right.

IMPORTANT: ATTACH A COPY OF YOUR FEDERAL RETURN TO THIS RETURN

PART I — Virginia Additions and Subtractions To Federal Income of Shareholders

SHAREHOLDERS

1. Name, Address

No.

2. Additions

3. Subtractions

4. Net Adjustments

and Social Security

o f

From Part II

From Part III

Difference Between

Number

Shares

Line 3

Line 6

Columns 2 and 3

A

SSN:

B

SSN:

C

SSN:

D

SSN:

E

SSN:

w

TOTALS

QUESTIONS

The corporation's books are in care of

located at

Has your federal income tax liability been redetermined for any prior year(s) which has not previously been reported to the Virginia

Department of Taxation? Yes

No

. If "yes", state years

. Report changes under separate

cover and mail to Virginia Department of Taxation, P.O. Box 1880, Richmond, Virginia 23218-1880.

Mail this return to the Virginia Department of Taxation, P.O. Box 1500, Richmond, Virginia 23218-1500 on or before the fifteenth day

of the fourth month following the close of the taxable year. Checks should be made payable to the Virginia Department of Taxation.

DECLARATION

I, the undersigned president, vice-president, treasurer, assistant treasurer, chief accounting officer, or other officer duly authorized to act, of the corporation for which this return is

made, declare under the penalties provided by law that this return (including any accompanying schedules and statements) has been examined by me and is, to the best of my

knowledge and belief, a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the income tax laws of the Commonwealth of Virginia. If prepared

by a person other than taxpayer, their declaration is based on all information of which they have any knowledge.

________________________

__________________________________________________________________________________________________

_______________________________________________________________

(Date)

(Signature and phone number of officer)

(Title)

________________________

__________________________________________________________________________________________________

_______________________________________________________________

(Date)

(Individual or firm, signature of preparer and phone number)

(Address)

(Preparer's SSN or FEIN)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2