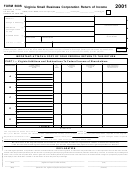

Form 500s - Virginia Small Business Corporation Return Of Income - 2003 Page 2

ADVERTISEMENT

PART II — Additions To Federal Taxable Income

2003

FORM 500S

page 2

TOTAL

SHAREHOLDERS' SHARE

AMOUNT

A

B

C

D

E

1 Interest on state obligations other than Virginia

2 (a) Fixed Date Conformity- Depreciation . . . . .

(b) Section 179 Expenses . . . . . . . . . . . . . . .

(c) Fixed Date Conformity- Disposed Asset . .

(d) Other Fixed Date Changes Not Listed . . . .

(e) Other (see instructions) . . . . . . . . . . . . . . .

3 Total additions 1 and 2 (a) - (e) . . . . . . . . . . . . .

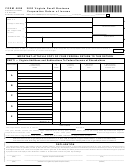

PART III — Subtractions From Federal Taxable Income

TOTAL

SHAREHOLDERS' SHARE

AMOUNT

A

B

C

D

E

4 Income from obligations of the

United States (see instructions) . . . . . . . . . . . .

5 (a) Fixed Date Conformity - Depreciation . . . .

(b) Fixed Date Conformity -Disposed Asset . .

(c) Other Fixed Date Changes Not Listed . . . .

(d) Other (see instructions) . . . . . . . . . . . . . . .

6 Total subtractions- Add lines 4 and 5(a) - (d) . . .

PART IV — Distributable Income Eligible For Enterprise Zone Tax Credit

TOTAL

SHAREHOLDERS' SHARE

AMOUNT

A

B

C

D

E

7 Shareholders' share of income eligible

for the Enterprise Zone credit

PART V — For Nonresidents Only: Income From Virginia Sources

TOTAL

SHAREHOLDERS' SHARE

AMOUNT

A

B

C

D

E

8 Nonresident shareholders' share of income from

Virginia sources (Enter on Form 763, Line 55)

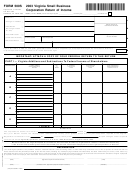

PART VI — Credits To Tax

TOTAL

SHAREHOLDERS' SHARE

AMOUNT

A

B

C

D

E

9 Neighborhood Assistance Act . . . . . . . . . . . . .

10 Conservation Tillage Equipment . . . . . . . . . . .

11 Fertilizer & Pesticide Application Equipment . . .

12 Recyclable Materials Processing Equipment . .

13 Rent Reduction Program Credit . . . . . . . . . . . .

14 Vehicle Emissions Testing Equipment, Clean-

Fuel Vehicle & Certain Refueling Property Credit

15 Income taxes paid to other states in the U.S. .

16 Major Business Facility Job Credit . . . . . . . . .

17 Historic Rehabilitation Credit . . . . . . . . . . . . . .

18 Day-Care Facility Investment Credit . . . . . . . .

19 Agricultural Best Management Practices Credit

20 Low-Income Housing Credit . . . . . . . . . . . . . .

21 Qualified Equity & Subordinated Debt Investment

22 Worker Retraining Credit . . . . . . . . . . . . . . . . .

23 Waste Motor Oil Burning Equipment Credit . . .

24 Credit for Employers of TANF Recipients . . . .

25 Credit for Employers of Disabled Individuals . .

26 Coalfield Employment Enhancement Credit Claim

27 Riparian Forest Buffer Protection for Waterways

28 Land Preservation . . . . . . . . . . . . . . . . . . . . . .

29 Coal Employment & Production Incentive Credit

30 Total Credits . . . . . . . . . . . . . . . . . . . . . . . . . .

PART VII — Coalfield Employment Enhancement Tax Credit Earned

(Check coalfield credit box on front)

TOTAL

SHAREHOLDERS' SHARE

31 Coalfield Employment

AMOUNT

A

B

C

D

E

Enhancement Tax Credit Earned

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2