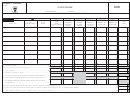

Schedule F Individual - Other Income - 2004 Page 2

ADVERTISEMENT

Schedule F Individual - Page 2

Rev. 05.04

Part II

Corporate Dividends and Partnerships Distributions

34

Column A

Column B

Employer's Identification

Account Number

Payer's name

Number

Not subject to withholding

Subject to withholding

(01)

00

00

(02)

00

00

(03)

00

00

(04)

00

00

(05)

00

00

(06)

00

00

00

Total distributed amount ......................................................................

(07)

00

1.

...................................................................................................................................

(

)

Less: Exempt amount from dividends distributed under Act No. 26 of 1978 ....................................................................................................................................

00

2.

Total (Transfer the total of Column B to Part 2, line 2E of the return )................................................................................................................................................

00

3.

(10)

Special tax: 10% of Column A (Enter in Part 4, line 19 of the return).......................................................................................................................................

4.

(08)

00

Tax withheld (Submit Form 480.6B. Enter on Schedule B Individual, Part III, line 5) ..........

5.

....................................................................................

(09)

00

NOTE: If you elected to include the distribution indicated in Column A as ordinary income, do not consider line 4 and transfer the total of

line 1, Column A to Part 2, line 2D of the return.

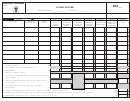

Part III

Special Partnerships Profits

(SUBMIT SCHEDULE R - SEE INSTRUCTIONS)

40

Profits

Payer's name

Employer's Identification Number

(01)

00

(02)

00

(03)

00

Total Profits (Transfer to Part 2, line 2B of the return)...............................

.................................................................................................................................................................................

00

(04)

Part IV

Profits from Subchapter N Corporations of Individuals

Profits or Losses

Payer's name

Employer's Identification Number

(05)

00

(06)

00

(07)

00

Net profit

00

Less: Losses from previous years

(Submit Schedule)

(

)

00

00

Total Profits

(Transfer to Part 2, line 2F of the return. If it is less than zero, enter zero)...................................................................................................................................................................

(08)

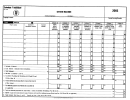

Part V

Distributions and Transfers from the Retirement Saving Accounts Program

Column A

Column B

Column C

Description

Distributions under

Lump-sum distributions

Transfers under

($10,000 or more)

Section 1169B

$10,000

1.

Total distributed or transferred (Transfer the amount of Column A to Part 2, line 2G of the return) ....................................................

(09)

00

00

(10)

00

(11)

2.

Tax on distributions or transfers (10% tax of Column B or C. Enter in Part 4, line 23 of the return) ...........................................................................................................................................

00

(12)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3