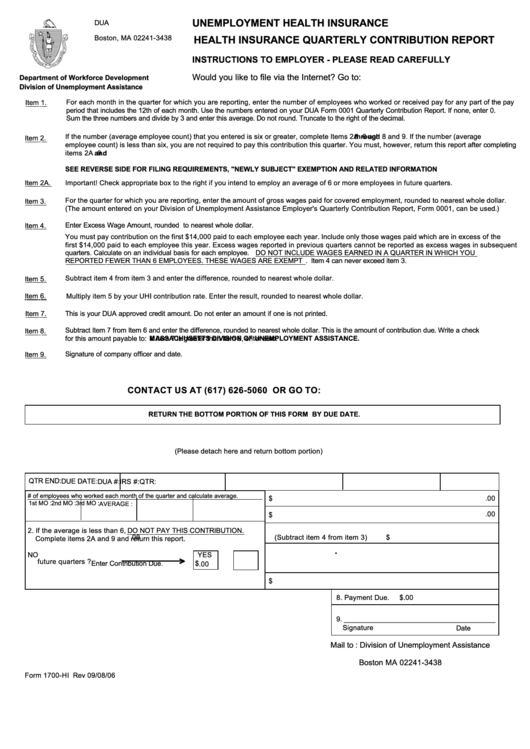

UNEMPLOYMENT HEALTH INSURANCE

DUA

P.O. BOX 3438

Boston, MA 02241-3438

HEALTH INSURANCE QUARTERLY CONTRIBUTION REPORT

INSTRUCTIONS TO EMPLOYER - PLEASE READ CAREFULLY

Would you like to file via the Internet? Go to: https://wfb.dor.state.ma.us/WebFile

Department of Workforce Development

Division of Unemployment Assistance

For each month in the quarter for which you are reporting, enter the number of employees who worked or received pay for any part of the pay

Item 1.

period that includes the 12th of each month. Use the numbers entered on your DUA Form 0001 Quarterly Contribution Report. If none, enter 0.

Sum the three numbers and divide by 3 and enter this average. Do not round. Truncate to the right of the decimal.

If the number (average employee count) that you entered is six or greater, complete Items 2A

through

6 and 8 and 9. If the number (average

Item 2.

employee count) is less than six, you are not required to pay this contribution this quarter. You must, however, return this report after completing

items 2A

and

9.

SEE REVERSE SIDE FOR FILING REQUIREMENTS, "NEWLY SUBJECT" EXEMPTION AND RELATED INFORMATION

Item 2A.

Important! Check appropriate box to the right if you intend to employ an average of 6 or more employees in future quarters.

For the quarter for which you are reporting, enter the amount of gross wages paid for covered employment, rounded to nearest whole dollar.

Item 3.

(The amount entered on your Division of Unemployment Assistance Employer's Quarterly Contribution Report, Form 0001, can be used.)

Item 4.

Enter Excess Wage Amount, rounded to nearest whole dollar.

You must pay contribution on the first $14,000 paid to each employee each year. Include only those wages paid which are in excess of the

first $14,000 paid to each employee this year. Excess wages reported in previous quarters cannot be reported as excess wages in subsequent

quarters. Calculate on an individual basis for each employee.

DO NOT INCLUDE WAGES EARNED IN A QUARTER IN WHICH YOU

REPORTED FEWER THAN 6 EMPLOYEES. THESE WAGES ARE EXEMPT

. Item 4 can never exceed item 3.

Subtract item 4 from item 3 and enter the difference, rounded to nearest whole dollar.

Item 5.

Item 6.

Multiply item 5 by your UHI contribution rate. Enter the result, rounded to nearest whole dollar.

This is your DUA approved credit amount. Do not enter an amount if one is not printed.

Item 7.

Subtract Item 7 from Item 6 and enter the difference, rounded to nearest whole dollar. This is the amount of contribution due. Write a check

Item 8.

for this amount payable to:

MASSACHUSETTS DIVISION OF UNEMPLOYMENT ASSISTANCE.

If Item 7 is greater than Item 6, enter zero.

Signature of company officer and date.

Item 9.

CONTACT US AT (617) 626-5060 OR GO TO:

RETURN THE BOTTOM PORTION OF THIS FORM BY DUE DATE.

(Please detach here and return bottom portion)

QTR END:

DUE DATE:

DUA #:

IRS #:

QTR:

1.Indicate # of employees who worked each month of the quarter and calculate average.

.00

3.Gross wages.

$

1st MO :

2nd MO :

3rd MO :

AVERAGE :

.00

4.Excess wages.

$

5.Wages subject to contribution.

2. If the average is less than 6,

DO NOT PAY THIS CONTRIBUTION.

.00

(Subtract item 4 from item 3)

$

Complete items 2A and 9 and return this report.

.

6.Multiply Item 5 by

2A.Do you plan to employ six or more in

YES

NO

—————— >

future quarters ?

Enter Contribution Due.

$

.00

7.Credit Amount.

$

8. Payment Due.

$

.00

9. ________________________________________

Signature

Date

Mail to : Division of Unemployment Assistance

P.O. Box 3438

Boston MA 02241-3438

Form 1700-HI Rev 09/08/06

1

1