Instructions For Form Va-4p - Personal Exemption Worksheet

ADVERTISEMENT

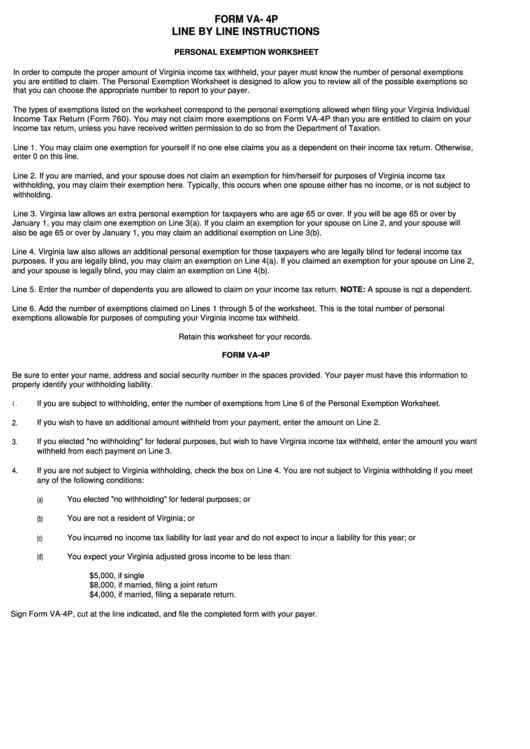

FORM VA- 4P

LINE BY LINE INSTRUCTIONS

PERSONAL EXEMPTION WORKSHEET

In order to compute the proper amount of Virginia income tax withheld, your payer must know the number of personal exemptions

you are entitled to claim. The Personal Exemption Worksheet is designed to allow you to review all of the possible exemptions so

that you can choose the appropriate number to report to your payer.

The types of exemptions listed on the worksheet correspond to the personal exemptions allowed when filing your Virginia Individual

Income Tax Return (Form 760). You may not claim more exemptions on Form VA-4P than you are entitled to claim on your

income tax return, unless you have received written permission to do so from the Department of Taxation.

Line 1. You may claim one exemption for yourself if no one else claims you as a dependent on their income tax return. Otherwise,

enter 0 on this line.

Line 2. If you are married, and your spouse does not claim an exemption for him/herself for purposes of Virginia income tax

withholding, you may claim their exemption here. Typically, this occurs when one spouse either has no income, or is not subject to

withholding.

Line 3. Virginia law allows an extra personal exemption for taxpayers who are age 65 or over. If you will be age 65 or over by

January 1, you may claim one exemption on Line 3(a). If you claim an exemption for your spouse on Line 2, and your spouse will

also be age 65 or over by January 1, you may claim an additional exemption on Line 3(b).

Line 4. Virginia law also allows an additional personal exemption for those taxpayers who are legally blind for federal income tax

purposes. If you are legally blind, you may claim an exemption on Line 4(a). If you claimed an exemption for your spouse on Line 2,

and your spouse is legally blind, you may claim an exemption on Line 4(b).

Line 5. Enter the number of dependents you are allowed to claim on your income tax return. NOTE: A spouse is not a dependent.

-

Line 6. Add the number of exemptions claimed on Lines 1 through 5 of the worksheet. This is the total number of personal

exemptions allowable for purposes of computing your Virginia income tax withheld.

Retain this worksheet for your records.

FORM VA-4P

Be sure to enter your name, address and social security number in the spaces provided. Your payer must have this information to

properly identify your withholding liability.

If you are subject to withholding, enter the number of exemptions from Line 6 of the Personal Exemption Worksheet.

1 .

If you wish to have an additional amount withheld from your payment, enter the amount on Line 2.

2.

3.

If you elected "no withholding" for federal purposes, but wish to have Virginia income tax withheld, enter the amount you want

withheld from each payment on Line 3.

4.

If you are not subject to Virginia withholding, check the box on Line 4. You are not subject to Virginia withholding if you meet

any of the following conditions:

(a)

You elected "no withholding" for federal purposes; or

You are not a resident of Virginia; or

(b)

You incurred no income tax liability for last year and do not expect to incur a liability for this year; or

(c)

(d)

You expect your Virginia adjusted gross income to be less than:

$5,000, if single

$8,000, if married, filing a joint return

$4,000, if married, filing a separate return.

Sign Form VA-4P, cut at the line indicated, and file the completed form with your payer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1