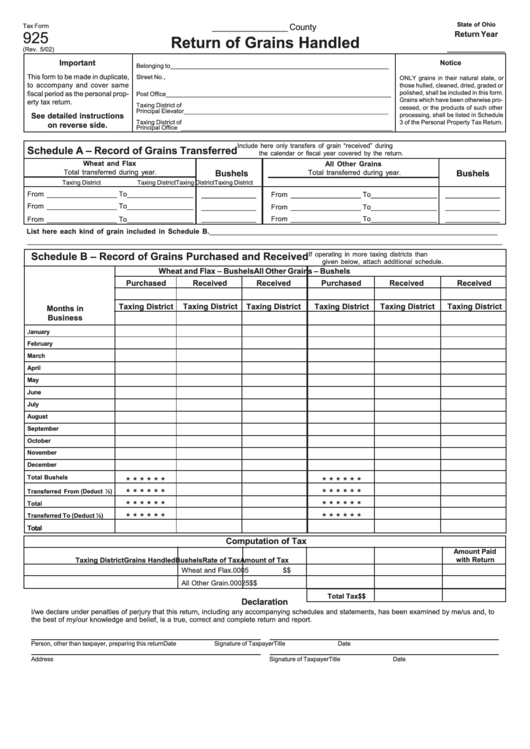

Form 925 - Return Of Grains Handled

ADVERTISEMENT

State of Ohio

________________ County

Tax Form

925

Return Year

Return of Grains Handled

__________

(Rev. 5/02)

Important

Notice

Belonging to ________________________________________________________________

This form to be made in duplicate,

Street No.,

ONLY grains in their natural state, or

R.F.D. _____________________________________________________________________

to accompany and cover same

those hulled, cleaned, dried, graded or

fiscal period as the personal prop-

polished, shall be included in this form.

Post Office __________________________________________________________________

Grains which have been otherwise pro-

erty tax return.

Taxing District of

cessed, or the products of such other

Principal Elevator ____________________________________________________________

See detailed instructions

processing, shall be listed in Schedule

Taxing District of

3 of the Personal Property Tax Return.

on reverse side.

Principal Office ______________________________________________________________

Include here only transfers of grain “received” during

Schedule A – Record of Grains Transferred

the calendar or fiscal year covered by the return.

Wheat and Flax

All Other Grains

Total transferred during year.

Bushels

Total transferred during year.

Bushels

Taxing District

Taxing District

Taxing District

Taxing District

From __________________ To _________________

______________

From __________________ To _________________

______________

From __________________ To _________________

______________

From __________________ To _________________

______________

______________

From __________________ To _________________

______________

From __________________ To _________________

List here each kind of grain included in Schedule B. __________________________________________________________________________

__________________________________________________________________________________________________________________________

Schedule B – Record of Grains Purchased and Received

If operating in more taxing districts than

given below, attach additional schedule.

Wheat and Flax – Bushels

All Other Grains – Bushels

Purchased

Received

Received

Purchased

Received

Received

Taxing District

Taxing District

Taxing District

Taxing District

Taxing District

Taxing District

Months in

Business

January

February

March

April

May

June

July

August

September

October

November

December

Total Bushels

* * * * * *

* * * * * *

* * * * * *

* * * * * *

Transferred From (Deduct ½)

* * * * * *

* * * * * *

Total

* * * * * *

* * * * * *

Transferred To (Deduct ½)

Total

Computation of Tax

Amount Paid

Taxing District

Grains Handled

Bushels

Rate of Tax

Amount of Tax

with Return

Wheat and Flax

.0005

$

$

All Other Grain

.00025

$

$

Total Tax

$

$

Declaration

I/we declare under penalties of perjury that this return, including any accompanying schedules and statements, has been examined by me/us and, to

the best of my/our knowledge and belief, is a true, correct and complete return and report.

Person, other than taxpayer, preparing this return

Date

Signature of Taxpayer

Title

Date

Address

Signature of Taxpayer

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1