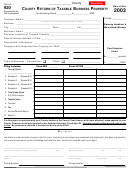

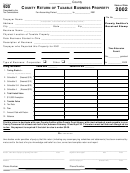

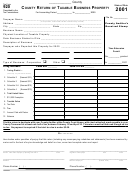

Form 925 - County Return Of Grains Handled

ADVERTISEMENT

Form 925

Rev. 11/05

Page 2

Filing Requirements

ment from one place of business to another in this state with-

out a change in ownership. In this schedule, all transfers from

The “County Return of Grains Handled,” form 925, is required

a particular place of business to one other place of business

to be filed by any person, firm, partnership, association, cor-

may be grouped. Transfers from a particular place of busi-

poration or fiduciary receiving or purchasing grain in Ohio, ex-

ness to different places of business cannot be grouped.

cept a public utility, track buyer or farmer acquiring grains

intended to be used by him on the farm or a manufacturer

Transfers are limited to grain “received.” The taxing districts

receiving or purchasing grain for use in his business.

referred to in this schedule are the taxing districts or the place

of business from which shipped and where shipped.

Instructions

Wheat and flax are subject to a rate of tax different from that

Grain “received” must be listed in the taxing district where

for other grains. Therefore, transfers of wheat and flax must

received.

be segregated and listed separately.

Grain “purchased” for the purpose of shipment from a place in

Carry one-half of the bushels transferred FROM each taxing

this state without actually receiving custody or possession,

district shown in Schedule A to the “Transferred FROM” line in

must be listed in the taxing district where the purchaser main-

Schedule B and deduct from the total bushels listed.

tains an elevator, warehouse or other like facility; otherwise,

Carry one-half of the total bushels transferred TO each taxing

such grains are to be listed where the purchaser maintains

district showing Schedule A to the “Transferred TO” line in

his principal office or place of business, which in the case of

Schedule B and deduct from the total bushels listed.

an individual having no other place of business or office in this

state, shall be his residence.

Schedule B

Grain “transferred” from one place of business to another in

The number of bushels and wheat and flax, and all other grains,

this state without a change in ownership, is to be listed one-

purchased or received (“received” to include all “transfers”)

half in the taxing district from which shipped and one-half in

during each month of the calendar or fiscal year preceding tax

the taxing district where shipped. The mechanical arrange-

listing day, must be listed separately in this schedule under

ment of the form is such as to automatically make this distri-

the appropriate heading.

bution.

After making adjustments for transfers of grain, the total bushels

Schedule A

must be carried forward to the computation of tax.

All “transfers” of grain must be listed in this schedule for distri-

bution between taxing districts. A “transfer” of grain is the ship-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1