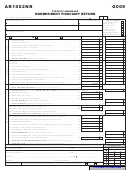

Dor/dmv Form 592 - Ethanol Producer Return - 2009 Page 2

ADVERTISEMENT

have their licenses reviewed. Records are to be maintained for a period of at least 30 days

at the delivery location or a location approved by the Secretary. All records must be

preserved for the current year and the three preceding calendar years.

Fuel Sales, Purchase and Shipping Records

Licensed Ethanol Producers must keep all sales and purchase invoices in either their

original format, through film retrieval or electronic media. They must also maintain

shipping records that indicate the destination state for all products sold. The Consignee

must also be identified on all bills of lading. The titles “Unlisted” and/or “Unknown” are

not acceptable names for the Consignee listed on the bill of lading, since the Supplier

should know who is purchasing the fuel. If a shipment is going to multiple locations in a

state, the title “Various” may be used on the bill of lading to identify destination cities, but

the titles “Unlisted” and/or “Unknown” are not acceptable. Bills of lading will also be

retained in their original format, film retrieval or electronic media.

The Secretary of Revenue & Regulation may require other pertinent records and papers

necessary for the enforcement of fuel tax laws, including purchase records, journals,

ledgers, payment records and banking records.

Sales Records

Licensed Ethanol Producers must keep all sales invoices which must show the following:

• The seller’s name and address, which shall be machine-printed or rubber stamped;

• The purchaser’s name and address;

• The date of sale and delivery of the fuel;

• The number of gallons sold and delivered to the purchaser, the type of fuel and if

diesel whether it was dyed or undyed;

• The price charged per gallon;

• The amount of fuel tax or sales tax charged, if any; and

• The total amount of the sales invoice

All invoices must be prepared on NCR (no carbon required) paper with double-faced

carbon so that the back of the invoice bears a carbon impression of the data on the front.

Other Records Required of Ethanol Producers

Ethanol Producers are required to maintain inventory records that show the total gallons on

hand at the beginning of the month, the total gallons produced during the month, the total

gallons sold during the month, and the total gallons remaining in storage at the end of the

month. Ethanol Producers must keep records that show the total number of ethyl alcohol

gallons produced out of state each month. Total gallons of natural gasoline and/or gasoline

used to denature the alcohol during the reporting period are also required.

Ethanol Producers are required to keep all alcohol denaturing records. The Ethanol

Producer may denature alcohol by adding gasoline or natural gasoline to it in amounts

equal to at least 5 gallons of gasoline for each 95 gallons of alcohol. The alcohol may also

be denatured by any other method common in the industry.

31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5