Form Jfs 20129 - Instructions For Completing The Request To Amend Unemployment Compensation Quarterly Tax Return

ADVERTISEMENT

Instructions for Completing the

Request to Amend Unemployment Compensation Quarterly Tax Return

For greater accuracy and faster processing, employers are encouraged to submit their amendment online at

anytime of the day or night. If you prefer, you may submit your amendment by completing this form. If submitting your amendment on this

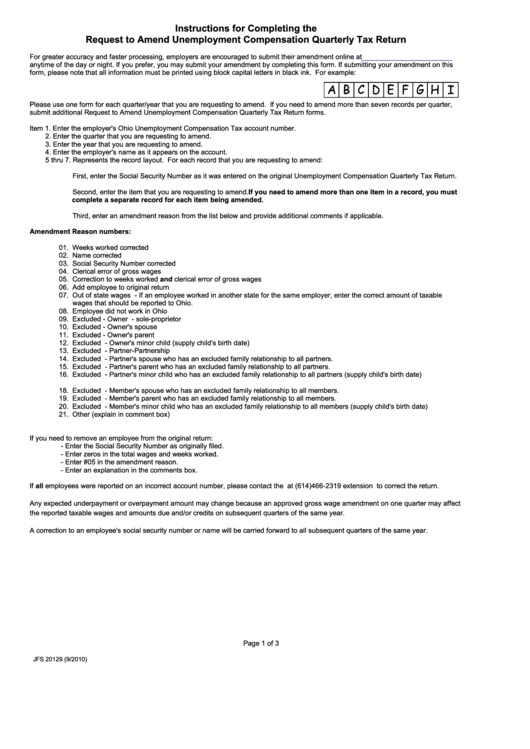

form, please note that all information must be printed using block capital letters in black ink. For example:

Please use one form for each quarter/year that you are requesting to amend. If you need to amend more than seven records per quarter,

submit additional Request to Amend Unemployment Compensation Quarterly Tax Return forms.

Item 1. Enter the employer's Ohio Unemployment Compensation Tax account number.

2. Enter the quarter that you are requesting to amend.

3. Enter the year that you are requesting to amend.

4. Enter the employer's name as it appears on the account.

5 thru 7. Represents the record layout. For each record that you are requesting to amend:

First, enter the Social Security Number as it was entered on the original Unemployment Compensation Quarterly Tax Return.

Second, enter the item that you are requesting to amend. If you need to amend more than one item in a record, you must

complete a separate record for each item being amended.

Third, enter an amendment reason from the list below and provide additional comments if applicable.

Amendment Reason numbers:

01. Weeks worked corrected

02. Name corrected

03. Social Security Number corrected

04. Clerical error of gross wages

05. Correction to weeks worked and clerical error of gross wages

06. Add employee to original return

07. Out of state wages - If an employee worked in another state for the same employer, enter the correct amount of taxable

wages that should be reported to Ohio.

08. Employee did not work in Ohio

09. Excluded - Owner - sole-proprietor

10. Excluded - Owner's spouse

11. Excluded - Owner's parent

12. Excluded - Owner's minor child (supply child's birth date)

13. Excluded - Partner-Partnership

14. Excluded - Partner's spouse who has an excluded family relationship to all partners.

15. Excluded - Partner's parent who has an excluded family relationship to all partners.

16. Excluded - Partner's minor child who has an excluded family relationship to all partners (supply child's birth date)

17. Excluded - Member- LLC or LTD filing as sole-proprietor or partnership

18. Excluded - Member's spouse who has an excluded family relationship to all members.

19. Excluded - Member's parent who has an excluded family relationship to all members.

20. Excluded - Member's minor child who has an excluded family relationship to all members (supply child's birth date)

21. Other (explain in comment box)

If you need to remove an employee from the original return:

- Enter the Social Security Number as originally filed.

- Enter zeros in the total wages and weeks worked.

- Enter #05 in the amendment reason.

- Enter an explanation in the comments box.

If all employees were reported on an incorrect account number, please contact the at (614)466-2319 extension to correct the return.

Any expected underpayment or overpayment amount may change because an approved gross wage amendment on one quarter may affect

the reported taxable wages and amounts due and/or credits on subsequent quarters of the same year.

A correction to an employee's social security number or name will be carried forward to all subsequent quarters of the same year.

Page 1 of 3

JFS 20129 (9/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1