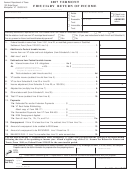

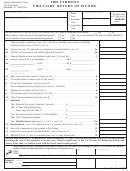

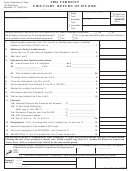

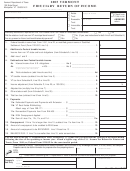

Form Fi-161 - Fiduciary Return Of Income - 2003 Page 2

ADVERTISEMENT

SCHEDULE A. TAXABLE MUNICIPAL BOND INCOME

16. Total interest and dividend income from all state and local obligations exempt from Federal tax 16. $

17. Interest and dividend income from Vermont state and local obligations included in Line 16. . . . 17.

18. Taxable municipal bond income (subtract Line 17 from Line 16, but not less than 0.) Enter here

and on Line 2. (If municipal bond income was distributed, it is not taxable on this return.) . . . . 18.

SCHEDULE B. TAX COMPUTATION

If using Federal Form 1041, go to Line 19; if using Federal Form 1120-SF, go to Line 24.

19. Vermont tax from tax rate schedule (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

20. Additions to Vermont tax

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

20a. Tax on lump-sum distributions (from Federal Form 1041,

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Schedule G, Line 1b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20a. _______________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

20b. Recapture of investment credit (from Federal Form 4255, Line 13) 20b. ______________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

20c. Total additions (add Lines 20a and 20b, then multiply by 24%) . . . . . . . . . . . . . . . . 20c.

21. Add Lines 19 and 20c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

22. Subtractions from Vermont tax

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

22a. Investment credit (from Federal Form 3468, Line 16) . . . . . . . 22a. _______________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

22b. Credit for prior year minimum tax (from Federal Form 1041,

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Schedule G, Line 2d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22b. ______________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

22c. Total subtractions (add Lines 22a and 22b, then multiply by 24%) . . . . . . . . . . . . . 22c.

23. Total tax. Subtract Line 22c from Line 21. Enter here and on Line 6.. . . . . . . . . . . . . . . . 23.

OR

24. If filing for Qualified Settlement Fund, enter amount from Line 14 from

Federal Form 1120-SF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

25. Multiply amount on Line 24 by 9.5% and enter here and on Line 6 . . . . . . . . . . . . . . . . . . 25.

SCHEDULE C. INCOME ADJUSTMENT

26. Total Income (from Schedule E, Line 45, Column A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

27. Non-Vermont income of nonresident or part-year resident estate or trust

(from Schedule E, Line 46) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.

28. Vermont income (subtract Line 27 from Line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

29. Adjustment percentage. Divide Line 28 by Line 26. Enter here and on Line 7 . . . . . . . . . 29.

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3