Form Tpg-042 - Designated Withholding Agent'S Withholding Remittance Coupon Package For Income Tax Withholding For Athletes Or Entertainers

ADVERTISEMENT

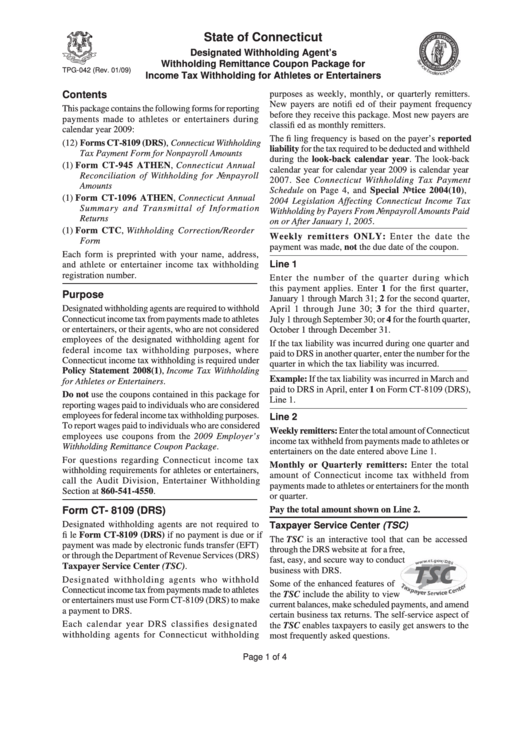

State of Connecticut

Designated Withholding Agent’s

Withholding Remittance Coupon Package for

TPG-042 (Rev. 01/09)

Income Tax Withholding for Athletes or Entertainers

Contents

purposes as weekly, monthly, or quarterly remitters.

New payers are notifi ed of their payment frequency

This package contains the following forms for reporting

before they receive this package. Most new payers are

payments made to athletes or entertainers during

classifi ed as monthly remitters.

calendar year 2009:

The fi ling frequency is based on the payer’s reported

(12) Forms CT-8109 (DRS), Connecticut Withholding

liability for the tax required to be deducted and withheld

Tax Payment Form for Nonpayroll Amounts

during the look-back calendar year. The look-back

(1) Form CT-945 ATHEN, Connecticut Annual

calendar year for calendar year 2009 is calendar year

Reconciliation of Withholding for Nonpayroll

2007. See Connecticut Withholding Tax Payment

Amounts

Schedule on Page 4, and Special Notice 2004(10),

(1) Form CT-1096 ATHEN, Connecticut Annual

2004 Legislation Affecting Connecticut Income Tax

Summary and Transmittal of Information

Withholding by Payers From Nonpayroll Amounts Paid

Returns

on or After January 1, 2005.

(1) Form CTC, Withholding Correction/Reorder

Weekly remitters ONLY: Enter the date the

Form

payment was made, not the due date of the coupon.

Each form is preprinted with your name, address,

Line 1

and athlete or entertainer income tax withholding

registration number.

Enter the number of the quarter during which

this payment applies. Enter 1 for the first quarter,

Purpose

January 1 through March 31; 2 for the second quarter,

Designated withholding agents are required to withhold

April 1 through June 30; 3 for the third quarter,

Connecticut income tax from payments made to athletes

July 1 through September 30; or 4 for the fourth quarter,

or entertainers, or their agents, who are not considered

October 1 through December 31.

employees of the designated withholding agent for

If the tax liability was incurred during one quarter and

federal income tax withholding purposes, where

paid to DRS in another quarter, enter the number for the

Connecticut income tax withholding is required under

quarter in which the tax liability was incurred.

Policy Statement 2008(1), Income Tax Withholding

Example: If the tax liability was incurred in March and

for Athletes or Entertainers.

paid to DRS in April, enter 1 on Form CT-8109 (DRS),

Do not use the coupons contained in this package for

Line 1.

reporting wages paid to individuals who are considered

employees for federal income tax withholding purposes.

Line 2

To report wages paid to individuals who are considered

Weekly remitters: Enter the total amount of Connecticut

employees use coupons from the 2009 Employer’s

income tax withheld from payments made to athletes or

Withholding Remittance Coupon Package.

entertainers on the date entered above Line 1.

For questions regarding Connecticut income tax

Monthly or Quarterly remitters: Enter the total

withholding requirements for athletes or entertainers,

amount of Connecticut income tax withheld from

call the Audit Division, Entertainer Withholding

payments made to athletes or entertainers for the month

Section at 860-541-4550.

or quarter.

Pay the total amount shown on Line 2.

Form CT- 8109 (DRS)

Designated withholding agents are not required to

Taxpayer Service Center (TSC)

fi le Form CT-8109 (DRS) if no payment is due or if

The TSC is an interactive tool that can be accessed

payment was made by electronic funds transfer (EFT)

through the DRS website at for a free,

or through the Department of Revenue Services (DRS)

fast, easy, and secure way to conduct

Taxpayer Service Center (TSC).

business with DRS.

Designated withholding agents who withhold

Some of the enhanced features of

Connecticut income tax from payments made to athletes

the TSC include the ability to view

or entertainers must use Form CT-8109 (DRS) to make

current balances, make scheduled payments, and amend

a payment to DRS.

certain business tax returns. The self-service aspect of

Each calendar year DRS classifies designated

the TSC enables taxpayers to easily get answers to the

withholding agents for Connecticut withholding

most frequently asked questions.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4