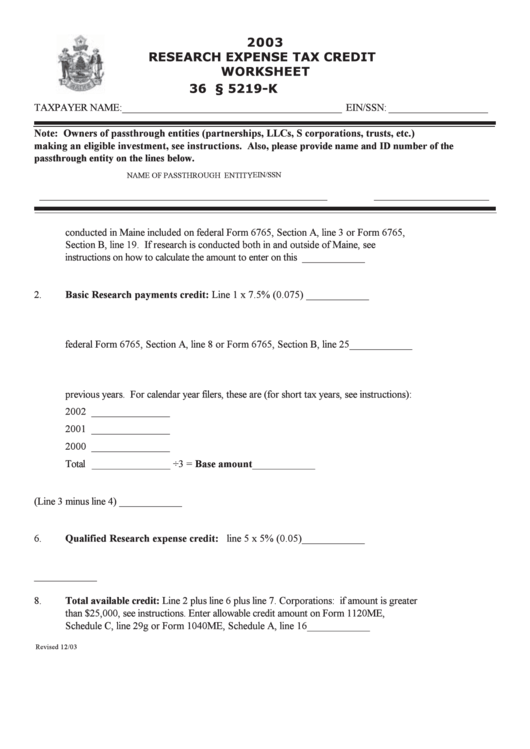

Research Expense Tax Credit Worksheet - Maine Department Of Revenue - 2003

ADVERTISEMENT

2003

RESEARCH EXPENSE TAX CREDIT

WORKSHEET

36 M.R.S.A. § 5219-K

TAXPAYER NAME: __________________________________________ EIN/SSN: ___________________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.)

making an eligible investment, see instructions. Also, please provide name and ID number of the

passthrough entity on the lines below.

EIN/SSN

NAME OF PASSTHROUGH ENTITY

_______________________________________________________

______________________

1.

Basic research payments in excess of the federal base that were spent for research

conducted in Maine included on federal Form 6765, Section A, line 3 or Form 6765,

Section B, line 19. If research is conducted both in and outside of Maine, see

instructions on how to calculate the amount to enter on this line. ...................................

____________

2.

Basic Research payments credit: Line 1 x 7.5% (0.075) ........................................

____________

3.

Total qualified research expenses spent for research conducted in Maine included on

federal Form 6765, Section A, line 8 or Form 6765, Section B, line 25 ........................

____________

4.

Total qualified research expenses spent on research conducted in Maine for the three

previous years. For calendar year filers, these are (for short tax years, see instructions):

2002 _______________

2001 _______________

2000 _______________

Total _______________ ÷3 = Base amount .........................................................

____________

5.

Qualified research expenses in excess of base amount (Line 3 minus line 4) ..................

____________

6.

Qualified Research expense credit: line 5 x 5% (0.05) .........................................

____________

7.

Carryover from previous years ....................................................................................

____________

8.

Total available credit: Line 2 plus line 6 plus line 7. Corporations: if amount is greater

than $25,000, see instructions. Enter allowable credit amount on Form 1120ME,

Schedule C, line 29g or Form 1040ME, Schedule A, line 16 .......................................

____________

Revised 12/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1