Form 150-301-015 - Property Return Extension Request

ADVERTISEMENT

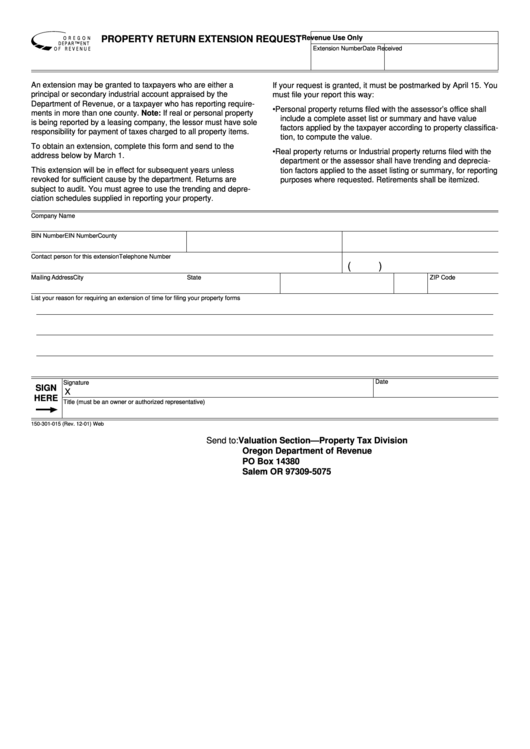

PROPERTY RETURN EXTENSION REQUEST

Revenue Use Only

O R E G O N

D E PA R T M E N T

Extension Number

Date Received

O F R E V E N U E

An extension may be granted to taxpayers who are either a

If your request is granted, it must be postmarked by April 15. You

principal or secondary industrial account appraised by the

must file your report this way:

Department of Revenue, or a taxpayer who has reporting require-

• Personal property returns filed with the assessor’s office shall

ments in more than one county. Note: If real or personal property

include a complete asset list or summary and have value

is being reported by a leasing company, the lessor must have sole

factors applied by the taxpayer according to property classifica-

responsibility for payment of taxes charged to all property items.

tion, to compute the value.

To obtain an extension, complete this form and send to the

• Real property returns or Industrial property returns filed with the

address below by March 1.

department or the assessor shall have trending and deprecia-

This extension will be in effect for subsequent years unless

tion factors applied to the asset listing or summary, for reporting

revoked for sufficient cause by the department. Returns are

purposes where requested. Retirements shall be itemized.

subject to audit. You must agree to use the trending and depre-

ciation schedules supplied in reporting your property.

Company Name

BIN Number

EIN Number

County

Contact person for this extension

Telephone Number

(

)

Mailing Address

City

State

ZIP Code

List your reason for requiring an extension of time for filing your property forms

Date

Signature

SIGN

X

HERE

Title (must be an owner or authorized representative)

150-301-015 (Rev. 12-01) Web

Send to: Valuation Section—Property Tax Division

Oregon Department of Revenue

PO Box 14380

Salem OR 97309-5075

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1