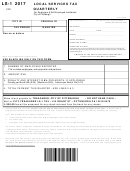

Form Lst-1 - Local Services Tax Return - Upper Merion Township Business Tax Office - 2017 Page 6

ADVERTISEMENT

INSTRUCTIONS TO EMPLOYER

1.

Forms must be filed on or before due date WITHIN THE QUARTER shown on the face of the form. PENALTY &

INTEREST are to be included if filed after the due date.

2.

It is the duty of the employer to collect the Local Services Tax (LST) from himself and all employees working within

the corporate limits of Upper Merion Township. Upper Merion Township LST rate is $52.00 per year. The mandated

collection method will be the $52.00 divided by the number of pay periods by the employer.

3.

There is a new low-income exemption for any individual who earns less than $12,000 in a calendar year. The

employee must notify the employer if they will be earning less than $12,000 within the year. A Local Services Tax

Exemption Certificate* must be completed in full with the attached documentation and forwarded along with the

LST-1 for employees who are claiming an exemption. (No exemption is to be given by the employer unless all proper

documentation is attached to the Local Services Tax Exemption Certificate.)**

4.

In the event that you have no employees from whom you are required to deduct the tax, IN the period shown write

the word NONE on line one (1) of the Form LST-1 “Employer’s Return,” sign the form and return to the Business Tax

Office to the address listed on the front of this form. (Exemption forms must be attached.)

5.

“Local Services Tax Deduction Certificate” forms are available upon request. The employee’s pay stub is sufficient

proof of Tax Deduction, however, individual employee receipts, Form LST-2, are available if required.

6.

Employer’s Listings of Employees’ names, Social Security numbers, Gross Wages and LST Amount withheld per

quarter and Amount withheld year to date whether or not computerized are acceptable.

7.

Individual shall mean any person, male or female, engaged in any occupation, trade or profession of any nature, type

or kind whatsoever, within the Corporate limit of the Township, whether in the employ of another or self-employed.

8.

Employees who have been terminated must be marked as terminated on the form with the termination date.

9.

If you as the employer fail to deduct the LST tax, you are responsible for same as though you did deduct it with the

exception of an Exemption Certificate along with the proper documentation.

10. You may contact us for a copy of the LST Ordinance No. 2007-763; this Ordinance is effective as of January 1, 2008.

** Local Services Tax Exemption Certificate Forms available at:

Click on link to Local Services Tax Information

(DCED)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8