Form St-R-16 - Exemption Application - Nonprofit Credit Union

ADVERTISEMENT

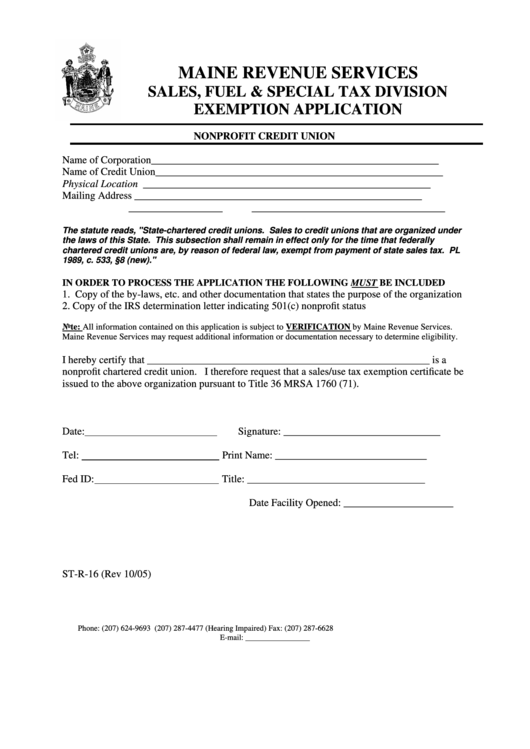

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

EXEMPTION APPLICATION

NONPROFIT CREDIT UNION

Name of Corporation_______________________________________________________

Name of Credit Union_______________________________________________________

Physical Location

_______________________________________________________

Mailing Address

_______________________________________________________

_______________________________________________________

The statute reads, "State-chartered credit unions. Sales to credit unions that are organized under

the laws of this State. This subsection shall remain in effect only for the time that federally

chartered credit unions are, by reason of federal law, exempt from payment of state sales tax. PL

1989, c. 533, §8 (new)."

IN ORDER TO PROCESS THE APPLICATION THE FOLLOWING MUST BE INCLUDED

1. Copy of the by-laws, etc. and other documentation that states the purpose of the organization

2. Copy of the IRS determination letter indicating 501(c) nonprofit status

Note: All information contained on this application is subject to VERIFICATION by Maine Revenue Services.

Maine Revenue Services may request additional information or documentation necessary to determine eligibility.

I hereby certify that ______________________________________________________ is a

nonprofit chartered credit union. I therefore request that a sales/use tax exemption certificate be

issued to the above organization pursuant to Title 36 MRSA 1760 (71).

Date:

Signature: ______________________________

Tel:

Print Name: _____________________________

Fed ID:

Title: __________________________________

Date Facility Opened: _____________________

ST-R-16 (Rev 10/05)

Phone: (207) 624-9693

(207) 287-4477 (Hearing Impaired)

Fax: (207) 287-6628

E-mail: salestax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1