Form Ar1055 - Instructions For Completion And Filing Of Extension Request - Arkansas

ADVERTISEMENT

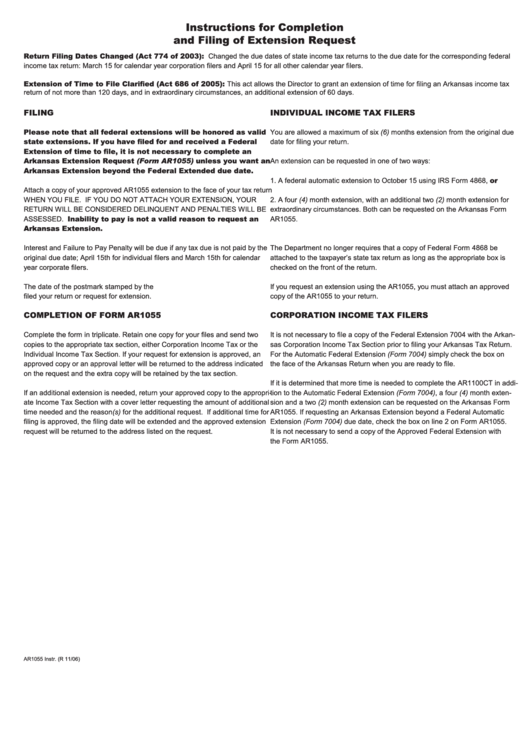

Instructions for Completion

and Filing of Extension Request

Return Filing Dates Changed (Act 774 of 2003): Changed the due dates of state income tax returns to the due date for the corresponding federal

income tax return: March 15 for calendar year corporation filers and April 15 for all other calendar year filers.

Extension of Time to File Clarified (Act 686 of 2005): This act allows the Director to grant an extension of time for filing an Arkansas income tax

return of not more than 120 days, and in extraordinary circumstances, an additional extension of 60 days.

FILING

INDIVIDUAL INCOME TAX FILERS

Please note that all federal extensions will be honored as valid

You are allowed a maximum of six (6) months extension from the original due

state extensions. If you have filed for and received a Federal

date for filing your return.

Extension of time to file, it is not necessary to complete an

Arkansas Extension Request (Form AR1055) unless you want an

An extension can be requested in one of two ways:

Arkansas Extension beyond the Federal Extended due date.

1. A federal automatic extension to October 15 using IRS Form 4868, or

Attach a copy of your approved AR1055 extension to the face of your tax return

WHEN YOU FILE. IF YOU DO NOT ATTACH YOUR EXTENSION, YOUR

2. A four (4) month extension, with an additional two (2) month extension for

RETURN WILL BE CONSIDERED DELINQUENT AND PENALTIES WILL BE

extraordinary circumstances. Both can be requested on the Arkansas Form

ASSESSED. Inability to pay is not a valid reason to request an

AR1055.

Arkansas Extension.

Interest and Failure to Pay Penalty will be due if any tax due is not paid by the

The Department no longer requires that a copy of Federal Form 4868 be

original due date; April 15th for individual filers and March 15th for calendar

attached to the taxpayer’s state tax return as long as the appropriate box is

year corporate filers.

checked on the front of the return.

The date of the postmark stamped by the U.S. Postal Service is the date you

If you request an extension using the AR1055, you must attach an approved

filed your return or request for extension.

copy of the AR1055 to your return.

COMPLETION OF FORM AR1055

CORPORATION INCOME TAX FILERS

Complete the form in triplicate. Retain one copy for your files and send two

It is not necessary to file a copy of the Federal Extension 7004 with the Arkan-

copies to the appropriate tax section, either Corporation Income Tax or the

sas Corporation Income Tax Section prior to filing your Arkansas Tax Return.

Individual Income Tax Section. If your request for extension is approved, an

For the Automatic Federal Extension (Form 7004) simply check the box on

approved copy or an approval letter will be returned to the address indicated

the face of the Arkansas Return when you are ready to file.

on the request and the extra copy will be retained by the tax section.

If it is determined that more time is needed to complete the AR1100CT in addi-

If an additional extension is needed, return your approved copy to the appropri-

tion to the Automatic Federal Extension (Form 7004), a four (4) month exten-

ate Income Tax Section with a cover letter requesting the amount of additional

sion and a two (2) month extension can be requested on the Arkansas Form

time needed and the reason(s) for the additional request. If additional time for

AR1055. If requesting an Arkansas Extension beyond a Federal Automatic

filing is approved, the filing date will be extended and the approved extension

Extension (Form 7004) due date, check the box on line 2 on Form AR1055.

request will be returned to the address listed on the request.

It is not necessary to send a copy of the Approved Federal Extension with

the Form AR1055.

AR1055 Instr. (R 11/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1