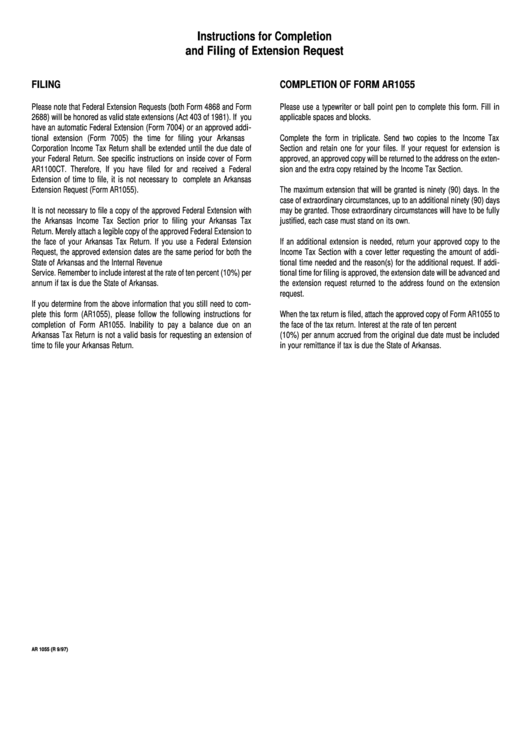

Instructions For Completion And Filing Of Extension Request Form Ar1055

ADVERTISEMENT

Instructions for Completion

and Filing of Extension Request

FILING

COMPLETION OF FORM AR1055

Please note that Federal Extension Requests (both Form 4868 and Form

Please use a typewriter or ball point pen to complete this form. Fill in

2688) will be honored as valid state extensions (Act 403 of 1981). If you

applicable spaces and blocks.

have an automatic Federal Extension (Form 7004) or an approved addi-

tional extension (Form 7005) the time for filing your Arkansas

Complete the form in triplicate. Send two copies to the Income Tax

Corporation Income Tax Return shall be extended until the due date of

Section and retain one for your files. If your request for extension is

your Federal Return. See specific instructions on inside cover of Form

approved, an approved copy will be returned to the address on the exten-

AR1100CT. Therefore, If you have filed for and received a Federal

sion and the extra copy retained by the Income Tax Section.

Extension of time to file, it is not necessary to complete an Arkansas

Extension Request (Form AR1055).

The maximum extension that will be granted is ninety (90) days. In the

case of extraordinary circumstances, up to an additional ninety (90) days

It is not necessary to file a copy of the approved Federal Extension with

may be granted. Those extraordinary circumstances will have to be fully

the Arkansas Income Tax Section prior to filing your Arkansas Tax

justified, each case must stand on its own.

Return. Merely attach a legible copy of the approved Federal Extension to

the face of your Arkansas Tax Return. If you use a Federal Extension

If an additional extension is needed, return your approved copy to the

Request, the approved extension dates are the same period for both the

Income Tax Section with a cover letter requesting the amount of addi-

State of Arkansas and the Internal Revenue

tional time needed and the reason(s) for the additional request. If addi-

Service. Remember to include interest at the rate of ten percent (10%) per

tional time for filing is approved, the extension date will be advanced and

annum if tax is due the State of Arkansas.

the extension request returned to the address found on the extension

request.

If you determine from the above information that you still need to com-

plete this form (AR1055), please follow the following instructions for

When the tax return is filed, attach the approved copy of Form AR1055 to

completion of Form AR1055. Inability to pay a balance due on an

the face of the tax return. Interest at the rate of ten percent

Arkansas Tax Return is not a valid basis for requesting an extension of

(10%) per annum accrued from the original due date must be included

time to file your Arkansas Return.

in your remittance if tax is due the State of Arkansas.

AR 1055 (R 9/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1