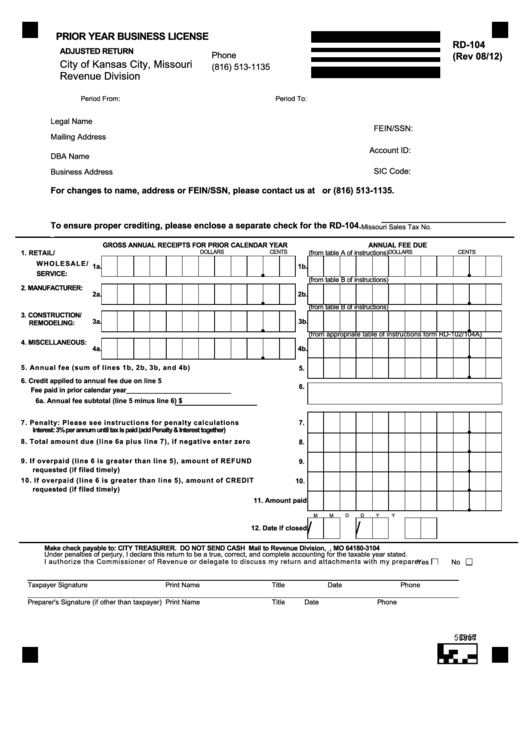

PRIOR YEAR BUSINESS LICENSE

RD-104

ADJUSTED RETURN

Phone

(Rev 08/12)

City of Kansas City, Missouri

(816) 513-1135

Revenue Division

Period From:

Period To:

Legal Name

FEIN/SSN:

Mailing Address

Account ID:

DBA Name

Business Address

SIC Code:

For changes to name, address or FEIN/SSN, please contact us at or (816) 513-1135.

To ensure proper crediting, please enclose a separate check for the RD-104.

Missouri Sales Tax No.

GROSS ANNUAL RECEIPTS FOR PRIOR CALENDAR YEAR

ANNUAL FEE DUE

DOLLARS

CENTS

(from table A of instructions)

DOLLARS

CENTS

1. RETAIL/

W HOLESALE/

1a.

1b.

SERVICE:

(from table B of instructions)

2. MANUFACTURER:

2a.

2b.

(from table B of instructions)

3. CONSTRUCTION/

3a.

3b.

REMODELING:

(from appropriate table of instructions form RD-102/104A)

4. MISCELLANEOUS:

4a.

4b.

5. Annual fee (sum of lines 1b, 2b, 3b, and 4b)

5.

6. Credit applied to annual fee due on line 5

6.

Fee paid in prior calendar year____________________________

6a. Annual fee subtotal (line 5 minus line 6) $

7. Penalty: Please see instructions for penalty calculations

7.

Interest: 3% per annum until tax is paid (add Penalty & Interest together)

8. Total amount due (line 6a plus line 7), if negative enter zero

8.

9. If overpaid (line 6 is greater than line 5), am ount of REFUND

9.

requested (if filed timely)

10. If overpaid (line 6 is greater than line 5), am ount of CREDIT

10.

requested (if filed timely)

11. Amount paid

M

M

D

D

Y

Y

/

/

12. Date if closed

Make check payable to: CITY TREASURER. DO NOT SEND CASH Mail to Revenue Division, P.O. Box 803104 Kansas City, MO 64180-3104

Under penalties of perjury, I declare this return to be a true, correct, and complete accounting for the taxable year stated.

I authorize the Comm issioner of Revenue or delegate to discuss m y return and attachments with m y preparer.

Yes

No

Taxpayer Signature

Print Name

Title

Date

Phone

Preparer's Signature (if other than taxpayer) Print Name

Title

Date

Phone

Draft

1

1